Whether you’re 25 or 55, it’s never too early to start saving for your retirement. One of the most popular ways to get started is with an IRA savings account.

IRA stands for “Individual Retirement Arrangement” and can be opened directly through the bank, brokerage firm or mutual fund of your choice. (Unlike a 401(k), it is not connected to your employer.)

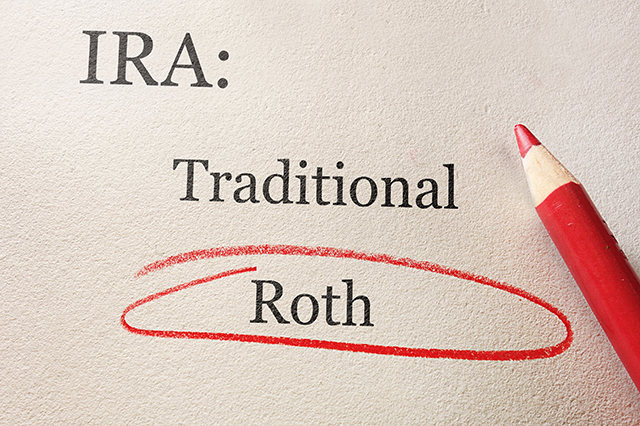

There are two types of IRA retirement accounts, traditional and Roth IRAs. We explain the differences between the two to help you decide which plan is right for you.

Traditional vs. Roth IRA Retirement Accounts

Are you eligible to open an IRA account? This will depend on your age and income.

To open a traditional IRA, there are no income limitations, but you must be younger than 70 ½ (or 72 if your 70th birthday is July 1, 2019 or later).

You can open a Roth IRA at any age, but in order to qualify, your yearly income must be under a certain amount depending on your tax filing status. Too high an income could limit the amount you’re allowed to contribute each year – or disqualify you entirely.

The amount you can contribute might also be limited based on your filing status and income. Check the IRS website for the most up-to-date information.

What’s The Big Difference?

Besides the age and income limitations, the biggest difference between IRA retirement accounts is in how they’re taxed. This difference is what will ultimately determine which type of IRA is right for you.

The traditional IRA allows you to claim an income tax deduction (both state and federal) of whatever amount you contributed to your IRA that year. Then, when you make withdrawals from your IRA during retirement, you will pay taxes on those distributions at ordinary income tax rates.

With the Roth IRA, there is no tax write-off for the contributions you make. However, all of your earnings and the withdrawals you make during retirement are tax-free.

Taxes Now or Taxes Later?

So, will you get a better tax deal by paying taxes now on your contributions, or by paying taxes during retirement on your withdrawals?

A traditional IRA is best if you’re currently in a higher tax bracket (above 20%) and you expect to be in a lower tax bracket upon retirement. This is typically true for folks who are currently at the peak of their career and expect to stop working or drastically reduce their income after age 70.

A Roth IRA will be best if you’re currently in a lower tax bracket (below 20%) and expect to be in a higher tax bracket upon retirement. This is typically true for folks who haven’t yet reached the peak of their career and also expect to be high earners past age 70.

You probably have a good guess of which category you fall into. However, since no one can truly predict the future, there’s a strong case to be made for diversifying your retirement savings. Consider investing in both a traditional and Roth IRA in order to spread out your tax burden. (Add a 401(k) to the mix and your retirement plan is golden!)

What If You Need Your Money Now?

Sometimes unexpected expenses arise. A perk of the Roth IRA is that you can withdraw your contributions at any time, both tax-free and penalty free. However, if you want to withdraw your earnings early, you’ll have to pay taxes and penalties unless you’re over age 59 ½ and have had your account for 5+ years, or if you have a “qualifying reason” (e.g., first time home buying, education, medical expenses).

For the traditional IRA, withdrawals after age 59 ½ are penalty-free, and withdrawals made before that will be penalized unless you have a qualifying reason.

What Happens When You Retire?

With a traditional IRA, at age 70 ½ (or 72 if your 70th birthday is July 1, 2019 or later) you must stop making contributions and begin taking “required minimum distributions.” This shouldn’t be a problem if you’re already retired, but if you’re still working and want to keep growing your IRA this could be an issue. (Plus, the taxes you’re paying on your distributions are at your current tax rate.)

In contrast, you can contribute to your Roth IRA indefinitely, and you are never required to make withdrawals. If you’re still working after age 70, this allows you the flexibility to wait until you actually need those funds – or to pass them on to your heirs.

Is an IRA retirement account part of your financial plan? Does the traditional or Roth IRA make more sense for you? Share your thoughts in the comments below!

Learn more about how to save at AAA.com/Financial.

2 Thoughts on “Traditional vs. Roth: Which IRA Retirement Plan is Right for You?”

Leave A Comment

Comments are subject to moderation and may or may not be published at the editor’s discretion. Only comments that are relevant to the article and add value to the Your AAA community will be considered. Comments may be edited for clarity and length.

I’m 90 and almost all my assets are in my Roth IRA accounts. How do I leave my heirs with Tax free income for the future? Can some go into a Special Needs Trust (already established)?

Hi Arthur, thanks for the question. We just recently published an article covering this subject that should provide you with some answers: https://magazine.northeast.aaa.com/daily/money/savings/money-to-grandkids/