Credit cards are quickly becoming the most popular way for consumers to pay for goods and services. They’ve been around for almost a century, and since then, they’ve completely changed the landscape of spending in America and around the world. Have you ever wondered about the credit card life cycle or how it’s made?

A short history of the credit card

Credit cards came into being in the United States during the 1920s, when companies started issuing them to customers to use within their establishment. In 1950, a universal credit card was introduced by Diner’s Club, Inc. This card could be used at a variety of establishments. American Express established a travel and entertainment card in 1958. This was the first system that charged annual fees and sent out bills on a regular, monthly basis. Merchants who accepted the card were expected to pay a service fee to the credit card issuer, usually 4% to 7% of the total charge.

Later in 1958, Bank of America started the bank credit card system, calling it the BankAmericard. With this system, banks credited merchant accounts as sales slips were received. The charges were billed to the cardholder at the end of the month with interest. Consumers could pay the bank in monthly installments. The program started in California and began spreading to other states in 1966. In 1976, the credit card system was renamed Visa.

How is a credit card made?

Now that you know how credit cards came about, are you curious about how they are manufactured? Over the years, credit cards have been made with metal, fiber, celluloid plastic and paper. Today, credit cards are made with thin sheets of laminate plastic known as polyvinyl chloride acetate or PVCA. The unique chemical composition and design of modern credit cards allows them to be flexible, durable and waterproof.

Credit card life cycle: The manufacturing process

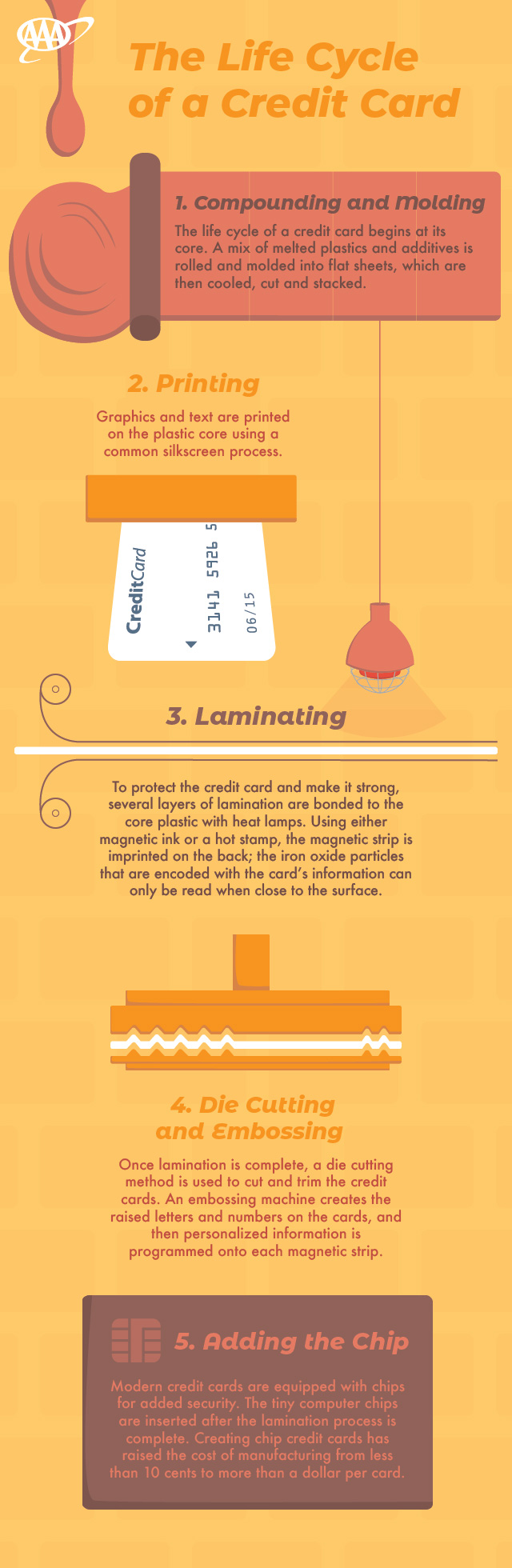

- Compounding and molding – The life cycle of a credit card begins when a formula is created by mixing melted polyvinyl chloride acetate with additives. The molten plastic is then rolled and molded into flat sheets. The sheets are cooled, cut, and stacked. The core and laminate sheets are made using a similar process, but the laminate sheets that coat the core are thinner and more transparent.

- Printing – Graphics and text are printed on the plastic core using a common silk screen process. The magnetic ink that forms the strip on the back of the card is imprinted on the laminated sheets because iron oxide particles can only be read when they are close to the surface of the card. This is done either by printing with magnetic ink or using a hot stamp on the surface of the card.

- Lamination – In order to protect the finish of the credit card and increase its strength, several layers of lamination are added to the core. Sheets of core plastic are fed through a system of rollers with laminate stock above and below. Heat lamps bond the laminate film to the core stock.

- Die cutting and embossing – Once lamination is complete, a die cutting method is used to cut and trim the credit cards. An embossing machine creates the raised letters and numbers on the cards, and then personalized information is programmed onto each magnetic strip.

- Adding the chip – Modern credit cards are equipped with a chip for added security. The tiny computer chips are inserted after the lamination process is complete. Creating chip credit cards has raised the cost of manufacturing from less than 10 cents to more than a dollar per card.

Credit card life cycle: Design

Before cards can be manufactured, there are lots of design elements to consider. Complex features help prevent and detect fraud. These include the magnetic strip and chip that we discussed earlier, but there are other innovative features that aren’t as noticeable.

- Your account number – Did you know that every credit card issuer relies on a different number of digits to ensure that card numbers are unique and nearly impossible to duplicate? Visa accounts have 13 digits, Master Card accounts have 20 and American Express cards have 15. The statistical security makes it very unlikely that someone will be able to make up a number and use it.

- The signature panel – The signature panel is printed with a unique design that will come off if the signature is ever erased or compromised.

- Holograms – Holograms have been a feature on credit cards for many decades. They were originally used to detect and prevent forgeries. Because most security breaches today do not stem from actual forgeries, modern holograms are mainly a unique design feature.

As technology changes, so will the manufacturing process for credit cards. Breakthroughs in digital technology will continue to improve credit card security, making theft and fraud more difficult.

What credit card design or safety features do you think are the most important in the credit card life cycle? Tell us in the comments section below.