Not too long ago, a trip to the bank was a usual item on everybody’s errand list. But times, they are a-changin’ – and faster than ever. Not only has visiting banks in person become less common, it’s also increasingly less possible, as banks are steadily closing branch offices. This isn’t anything new – the number of brick-and-mortar locations has dropped every year since 2012. 2020, however, was an outlier: The number of branches nationwide absolutely plummeted.

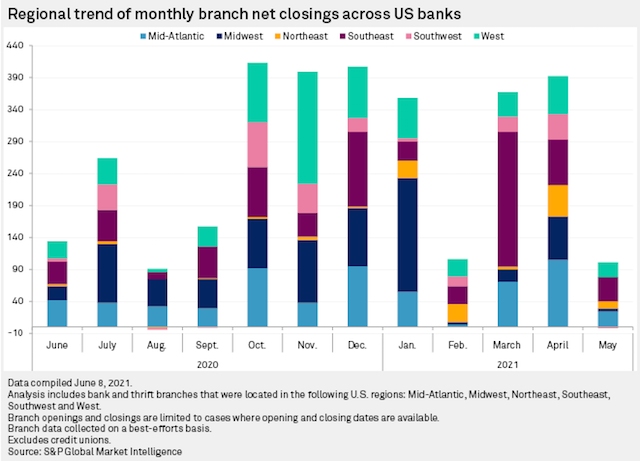

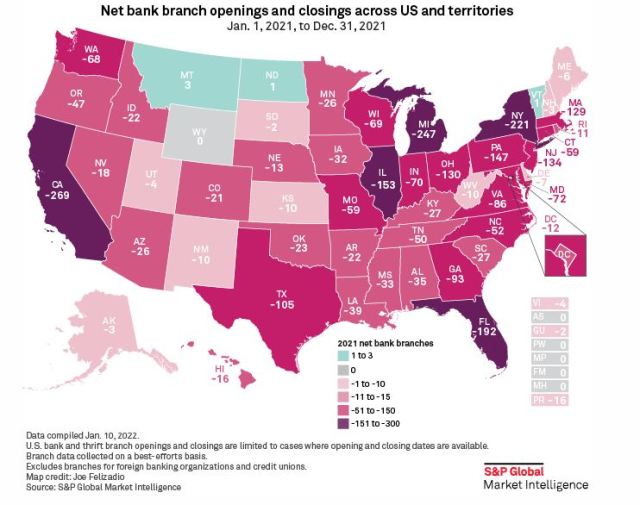

U.S. banks closed a total of 3,324 branches in 2020, while opening just 1,040, according to S&P Global Market Intelligence. The result was a record of 2,284 net closings in one year. (To put that number, which doesn’t include temporary closings due to COVID-19, into context, 1,391 branches closed in 2019.) The trend only continued in 2021. If things stay the same, physical bank branches could be extinct in the U.S. as soon as 2034.

This disappearing act begs two questions: Why are banks closing branches in the first place and what should you do if your bank branch closes?

Why Are Banks Closing Branches?

Like nearly every aspect of our lives, banking is moving further and further into the digital space. Indeed, the driving force behind the upswing in bank branch closings is the increased use of online and mobile banking. Customers can complete most, if not all, of their financial transactions digitally, which creates a waning demand for branch offices.

When banks further compare the cost of operating a brick-and-mortar location to simply offering their services online, the choice to close branches becomes even easier.

How Will I Know if My Bank Branch Is Closing?

Of all the factors surrounding a bank branch closure to be concerned about, learning of said closing should be at the bottom of the list. Banks are legally required to inform customers of a branch closing. The Federal Deposit Insurance Corporation Improvement Act of 1991 states the bank “must mail the notice to the customers of the branch proposed to be closed at least 90 days prior to the proposed closing. The institution also must post a notice to customers in a conspicuous manner on the premises of the branch proposed to be closed at least 30 days prior to the proposed closing.”

Additionally, the bank must either inform customers where they can obtain services after the branch closes or list a telephone number customers can call to get that information.

What Should I Do if My Bank Branch Closes?

Find the Nearest Bank Branch

If you’re accustomed to banking in-person and your home branch shutters, there’s no need to panic. You have a number of options at your disposal. The easiest solution is to simply find your bank’s nearest branch location. If it’s within a reasonable distance, there’s no need to alter anything else about your banking.

Odds are this option will be available to you. Most branch closures are occurring in saturated urban markets, according to the American Bankers Association Banking Journal. These areas typically have a higher density of branch locations, so if one closes, another one is likely nearby.

Check Local ATM Availability

If there’s not another branch location near you, or it’s too far to visit as often as you’d like, ask yourself if most of your physical banking transactions can be done through an ATM. If so, you may not need a branch. Many bank ATMs allow you to not only get cash, but deposit cash and checks, make transfers between accounts, and check account balances.

Do some research to see how many ATMs your bank has nearby. You can likely get by even if there is just one. You’ll also want to learn if there are nearby ATMs outside of your bank’s network you can use without a service fee.

Switch to Online Banking

As we’ve seen, your bank branch closing is a sign of the times — a trend that won’t likely go away anytime soon, if ever. Therefore, you could use it as the perfect motivation to switch to online banking.

Almost all major banks offer their services online, so switching over will require setting up an online account, which can be done in minutes. If available, you can also download your bank’s app, allowing you to access your account from your smartphone or tablet. Technology has jumped leaps and bounds in recent years; once you’re used to it, you could very well find online banking easier than anything you’ve done at a brick-and-mortar location. A perfect example: the ability to deposit a check simply by taking a photo of it on your phone.

Learn about how AAA and Discover can fulfill all of your online savings needs.

Find a New Bank

If you’ve exhausted all your other options to no avail, you can always switch to a bank with a local branch. It’s a more laborious process, but worth considering if a physical branch location is important to you.

Don’t be fixated solely on proximity. Research the banks in your area to see which one best fits all your financial needs.

Do you prefer banking in-person or online? Is having a branch nearby important to you? Let us know in the comments below!

16 Thoughts on “Why Are Banks Closing Branches?”

Leave A Comment

Comments are subject to moderation and may or may not be published at the editor’s discretion. Only comments that are relevant to the article and add value to the Your AAA community will be considered. Comments may be edited for clarity and length.

I have to agree with the person about bringing money to deposit. This world is too dangerous now for a ATM machine. At least one bank in each town should stay open and at a later time Monday and Friday.

It is very important for a lot of older folks that are not computer savvy to have a bank branch nearby their community, besides there is a lot of business that collect their sales in cash or mom and pap that own rental property and get paid in cash, you can’t bring all this cash into the “so call convenience” of the automatic teller many have been robed and some even hurt or killed.

Just the idea of being forced to use online banking bugs me. A lot of seniors aren’t use to banking online, and most don’t even know how to use a computer. The computer is very challenging for seniors, anyone who has not learned how to use a computer. What happens when there are no more in-person banks and your only option is to call the bank but when you call your bank and you can’t get through to speak to someone or the wait to talk to someone is 45 minutes or longer. I just think banks should consider everyone’s banking needs before rushing to close banks.

OPTIONS are important for bank customers. Some people select online transactions for their banking needs, and that’s fine. Other people, such as myself, prefer a convenient branch location, where I can speak to a teller or branch manager, regarding any account issues. (Calling an 800 number for the bank does not always resolve an issue, as efficiently as speaking directly to the local branch manager or teller.) Lastly, it would be helpful if the bank would include a brief online tutorial on their web site, (about the online banking system), for some customers who may need a little assistance trying to set up their account.

There should be a regulation that if a bank closes and you have to go to a different bank (not branch) there should be no loss of funds if you had a cd there as closing the cd was not by your choice.

I agree with all the above. Banks should have a banch open for customers to access their Vault if they have a box in it. Also to get their funds in the denominations that they want their cash in. The ATM won’t do this for them

technology is great until it doesn’t work with online transactions

less branches means less human interaction and less jobs!

online customer service is usually outsourced and is typically non existent

keep the branches open !

Back in the 60’s, banks invested in Automatic Teller Machines on the promise that they would eliminate. tellers. Never happened. There are more tellers now than ever, reduced branches not withstanding. One reason that banks are closing branches, not mentioned above, is that they opened too many. Those branches were all about selling new accounts to the great unbanked (in the 60s only one person in ten in Rhode Island and Providence Plantation had a checking account).

Why Do Banks Close Anyway, Without Asking Permission From They’re Customers Who they Owe their Very Lives To? Also The Digical Age Is Making People Very Lazy & Stupid!

At 84 I have more questions than answers. Although I pay my bills through my computer, it sometimes creates more problems. If my computer goes down, I wind up in LaLaLand. Will I have enough money to repair it. At least now I can go to the bank and pay the bill on their computer without incurring a late fee. Going into the bank and getting the explanations and help that I need to traverse the constant changes that occur while I am sleeping is so necessary. I certainly can follow instructions which, unfortunately, no longer comes with anything one buys especially computers.

, I’m 85 and I totally agree with all of the above comments. I miss my international institution but am lucky to have a small local bank

I agree with all the prior comments. Older people such as myself are not as technologically adept as younger people and also do not trust the security of ATMs. I also no longer have access to a safe deposit box since my branch closed and the the other banks in my area have no available boxes. I do zero financial transactions online because doing so only opens up a better chance of being hacked. I like going into the bank, coming face to face with bank staff who know me and can also answer any questions I may have. What the banks are doing does not consider the needs of an older and sometimes also handicapped population.

i

I like going to the bank in person. I do not trust ATM. I think it is taking peoples jobs away.

I prefer to bank in person so I can see the transaction right away. Also when I have a problem with my computer, I have to trust a complete stranger that I do not know. And I don’t have a cellphone (I am elderly 83 yrs.) Also, I need a safe-deposit box to store valuable documents etc., Martha

I am 83 and can walk to my branch if necessary. (If I live long enough, I will give up my car).

I like having a branch nearby for the convenience of seeing someone if there is a problem with any of the aspects of my banking needs.