Your AAA Wishlist is an online shopping guide. When you make a purchase through a third-party link, AAA Northeast could receive revenue.

Every once in a while it’s smart to stop and reevaluate your banking and money management plans. Are you getting the most out of your savings and retirement benefits? Thankfully, there are countless products available to help both the tech-savvy and otherwise among us keep track, save and invest like a pro. Take a look.

For the Kiddos

Fisher-Price Laugh and Learn Smart Stages Piggy Bank

An Amazon exclusive, the best-selling Fisher-Price Laugh and Learn Smart Stages Piggy Bank lets your baby get familiar with coins and saving while developing motor and language skills. Smart Stages technology allows content to change as your little one grows, so they can learn over 40 age-appropriate songs, phrases and counting in both English and Spanish as they stash their ten colorful coins in the bank. Level one is designed for ages 6 months and older, while level two advances to age 1 and older. Requires two AAA batteries; not included. Buy it here.

National Geographic Glowing Moon Bank

Give your kiddos a fun way to store their cash and coins while exploring facts about the moon. The National Geographic Glowing Moon Bank lights up to show off the craters across its surface and comes with a learning guide written by teachers. Perfect for any bedside table and a great gift for space lovers, this cool bank opens via the stopper at the bottom so you won’t need to break it to get the money out. Comes with a real meteorite sample from space and National Geographic’s 100% satisfaction guarantee. Recommended for ages 8 and up. Buy it here.

Money Bags Coin Value Game

Take a break from the usual board games and try the Learning Resources Money Bags Coin Value Game for family fun night! For ages 7 and up, two to four players can collect and count their money while learning how to identify cash and coins quickly and other valuable financial skills throughout the game. Comes with the colorfully-illustrated game board, a spinner, 100 plastic coins, ten play bills, markers and dice. Buy it here.

LEGO Creator Expert Brick Bank

For the master Lego builder, the LEGO Creator Expert Brick Bank 10251 Construction Set has everything a real bank has and then some. Your youth can enjoy assembling all the details of this gem, from the patterned tile floor to the vault. Recommended for kids ages 16 and over, it contains 2,380 pieces. A great family project, it’s also a good opportunity to get the conversation started on banking and saving money. Buy it here.

Household Safes and Money Planning Options

AmazonBasics Security Safe Box

Once you’ve earned the money, you want to keep it safe. Every household needs a safe, and the AmazonBasics Security Safe Box is a top-rated option. Pry-resistant with hidden hinges, this box can hold a range of items including cash, documents, jewelry, passports and more. Made of steel with carpeting on the bottom to prevent scratching wherever it’s placed, it has an electronic lock, two keys for times when emergency overrides are necessary and can be mounted to the floor, shelving or walls with the four included bolts. It comes in a variety of sizes and can be purchased alone or in a bundle with required batteries. Expert installation is available for a fee. Buy it here or opt for the slightly-larger, waterproof and fireproof SentrySafe.

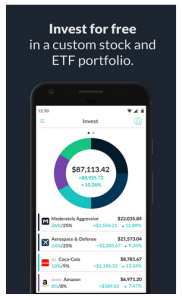

M1 Finance Investing App

Now available for free download on Amazon, the M1 Finance Investing App is one of numerous investment apps currently making hands-free, automated investing a popular way to optimize investments. They charge no fees to trade, no commission fees, no fees for changing your portfolio and no yearly management fees. There’s also no minimum balance to open an account, only $100 to begin investing and $500 required to begin a retirement account.

A combination of stock broker and robo-advisor, M1 Finance lets you select an investing plan, then the algorithm sells and buys strategically (“buys low and sells high”) on your behalf over time.

Ideal for those with a little bit of background knowledge on stocks (or willing to do some research), M1 Finance offers thousands of investment options including any of the 6,000 stocks or almost 2,000 ETFs traded on the major exchanges like NASDAQ, NYSE and BATS, while allowing the purchase of fractional shares up to one-thousandth of a share (useful for those wishing to buy partial shares of expensive stock like Google or Amazon). Buy it here.

For something a little simpler, check out the Spending Tracker app or the Debt Payoff Planner and Payment Tracker, also free.

Laminated Cash Envelope System and Budget Sheets

Envelope systems are smart way to budget cash. With 12 designs to choose from and budget sheets included, this Laminated Cash Envelope System makes it fun. Slide cash for all your expenses into each of these labeled, laminated envelopes to make sure you have it ready when bills are due. Buy it here.

Digital Coin Bank Savings Jar – Automatic Coin Counter

Save loose change and keep track of how much it’s worth with the Digital Coin Bank Savings Jr – Automatic Coin Counter. It counts and totals all U.S. coins including dollars and half dollars, with a digital LCD Display on the lid. Available in transparent pink, purple, blue and clear. Comes with a 100% money-back guarantee. Buy it here.

A Few Extra Money-Saving Tips

Negotiate rates down, eliminate fees and cancel subscriptions.

-

- Call credit card companies and loan lenders to see if you can get a lower rate. It can’t hurt to ask!

- Check your bank to see what fees you’re paying that you can avoid. Do they charge extra for paper statements? What about when your balance dips below $100? Make sure your fees are known, understood and either acceptable or unavoidable.

- Go through your bank statement and carefully search for subscriptions or other automated monthly or quarterly payments you’ve forgotten about. Don’t use Hulu anymore? Get rid of it!

Clip coupons, check for promo codes and check receipts.

- Clip coupons, but only for items you regularly buy. Buying something you don’t really want or need simply because there’s a coupon isn’t financially wise.

Which of these products would you like to try? Tell us in the comments.

For more help saving money, check out AAA Financial Services.