When unexpected worst-case scenarios occur that result in large claims or lawsuits, personal umbrella coverage offers extra protection to what your auto and homeowners insurance policies can provide. Before asking your insurance agent to add it to your policies, it’s a good idea to have a base understanding of umbrella insurance first.

What Is Umbrella Insurance?

Imagine if you were at fault for causing a multicar pileup and are responsible for all the resulting damages and medical bills. Or if someone falls and gets hurt on your property and sues you. These situations don’t happen often, but you might sleep better at night knowing that your finances would be protected if they ever did.

Think of umbrella insurance as your emergency parachute, the safety net below your tether and – most obviously – your umbrella in a storm. A raincoat may save you from the usual shower, but when a sudden downpour hits, you are going to wish you had the added protection.

“A [personal umbrella policy] provides an extra layer of security beyond the coverage limits of your auto or homeowners policy,” said Ray Eng, Vice President of Insurance Sales, with AAA Northeast.

For example, if your homeowners insurance policy has a $500,000 liability limit, but a catastrophic accident occurs and you are responsible for $1 million in property damage, legal fees and medical bills, it may cover the remaining $500,000 liability.

In addition to large claims and lawsuits, umbrella insurance covers liabilities your auto and home policies do not, like if you are sued for libel or defamation, defense costs and renting a vehicle in another country. It will not cover your own injuries or property damage, business-related matters or intentional acts.

There may be some exclusions and a minimum liability limit on the primary policy required to qualify for an umbrella policy.

Is an Umbrella Insurance Policy Right for You?

With today’s litigious society, protection with high liability limits could be invaluable. At the end of the day, we are all at risk for unexpected accidents and the possibility of getting sued. If you find yourself in a position where you are in over your head, an umbrella policy could save your finances.

Umbrella insurance covers the policyholder and members of their family or household, which makes it especially practical for homeowners and married couples.

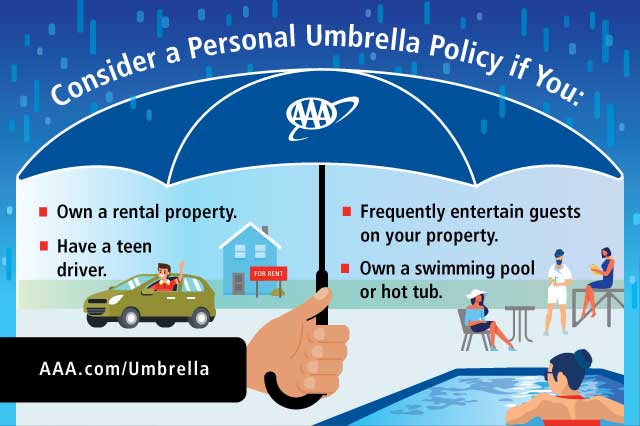

People that live with higher risks could also benefit from the extra cushion. You should consider the excess liability coverage from an umbrella policy if you:

- Have a young driver on your auto policy. Teens are statistically the riskiest drivers on the road, with a crash rate three times that of drivers age 20 and older.

- Frequently travel and rent vehicles abroad.

- Own a boat.

- Own a swimming pool or hot tub.

- Own rental property.

- Frequently entertain or host guests on your property.

Understanding if Umbrella Insurance Is Worth It for You

Umbrella insurance is notably affordable. For about $150 to $300 per year, you can buy a $1 million personal umbrella liability policy.

As it is designed to supplement your existing coverage, the low cost is likely because you are usually required to have larger liability limits on your home and auto policies to qualify.

“Most insurance carriers give a discount on both your home and auto insurance if you have both written through them,” said Emily Buckley, senior insurance agent for AAA Northeast in Garden City, N.Y. With the amount you save from bundling, it could make sense to invest in an umbrella policy.

How to Get an Umbrella Insurance Policy

Keep in mind that not all umbrella policies are the same and there may be exclusions or limitations. Consult with your insurance agent for help with any specific concerns or needs you may have.

Play Wordrow!

Hint: This keeps your insurance coverage active.

For more information on umbrella insurance, schedule an appointment with a AAA insurance agent.

Now that you have a better understanding of umbrella insurance, do you think that it’s the right choice for you? Do you already have it? Tell us in the comments.

5 Thoughts on “Understanding Umbrella Insurance”

Leave A Comment

Comments are subject to moderation and may or may not be published at the editor’s discretion. Only comments that are relevant to the article and add value to the Your AAA community will be considered. Comments may be edited for clarity and length.

We are in our 80’s . We have a $2M Umbrella Policy, Do we need it since we:

• no longer have a young driver on your auto policy.

• no longer travel and rent vehicles abroad.

• no longer Own a boat.

• no longer Own a swimming pool or hot tub.

• no longer own rental property.

• In-Frequently entertain or host guests on our rental property.

Hi Carl, it’s really up to you! If you’d like to learn more about your coverage options and what might work best for you, a AAA Insurance agent will be happy to assist. Click here to schedule a call or an appointment at your nearest AAA branch. 🙂

Know the difference between Umbrella and Excess Liability, and why there is another deductible with the Umbrella. Property damage liability is inadequate in more cases than not, since there are so many vehicles that exceed $100,000 on the roads.

Another important point is legal defense. When an insurer has a relatively small limit of liability, they may choose to settle for the policy limit and have no further obligation for defense. This can be financially devastating, too.

Does umbrella insurance pay for the attorney fee?

Hi Tom, good question! We asked Ray Eng, vice president of insurance for AAA Northeast. Here is his response: “It’s always best to consult with your agent concerning specific coverage questions. That said, umbrella policies do normally cover attorney’s fees and does so outside of your stated limits.”