Explore the most popular vacations booked by AAA Northeast members.

AAA members love to travel, and recent booking data shows where they’ve been heading most.

From Europe’s historic landmarks to the tropical shores of the Caribbean and family fun right here in the U.S., vacationers are prioritizing places where culture, adventure, multigenerational appeal and great value converge.

Join us as we explore must-see attractions, hidden gems and stays for every budget at each destination. When you’re ready, reach out to a AAA travel advisor to start planning your next trip. As a member, you can enjoy expert recommendations, exclusive perks and savings when you book.

CAN’T-MISS

Aruba is a desert island – a fact that quickly becomes clear once you venture beyond the hotel districts. The island’s sparsely populated east side is dotted with cactus, its rugged coastline fringed with cliffs frequently pounded by strong surf. Arikok, which covers about one-fifth of the island, attracts hikers with its high hills and cool caves. The national park also has a pair of undeveloped beaches and a natural pool sheltered from the wind and waves by rocks.

One of the island’s most photographed sites, savvy visitors head to the California Lighthouse in the evening to catch the great light and take in a sunset dinner at nearby Faro Blanco – an elegant Italian restaurant with a formal terrace overlooking the Caribbean Sea.

Aruba’s culinary diversity is reflected in top restaurants like Papiamento, named for the island’s local language, which serves upscale food in a historic Aruban country-style home known as a cunucu house. For other styles of cuisine, there’s French delicacies at Bohemian and Peruvian dishes at Lima Bistro. At Flying Fishbone, guests dine on fresh seafood on the beach.

Aruba’s resort area is concentrated on two beautiful beaches. Palm Beach is primarily home to larger, high-rise hotels and the hub for Aruba’s water sports and activities. The low-rise Eagle Beach is fringed by a lively boulevard lined with restaurants, shops and nightclubs. It’s not uncommon for vacationers to go hotel hopping, seeing what each has to offer.

Those who have been on an Aruba cruise might be familiar with the downtown trolley in the capital city of Oranjestad. The hop-on, hop-off streetcar leads from the cruise port to the shopping district, including a smattering of interesting museums and the distillery, Pepe Margo, where visitors can sample and purchase locally made spirits in a traditional Aruban home.

“Aruba is an extremely safe island, which appeals to a lot of people. It’s OK to walk around at night. It’s got great all-inclusive resorts, and it’s also an excellent place to stay at a non-all-inclusive hotel because there are so many restaurants to choose from.”

WHERE TO STAY

Located in Palm Beach, this is a versatile and convenient choice for families. Featuring a long stretch of beachfront property, three pools, a spa, casino, nearby shopping and more, there is something for everyone in your crew. All-inclusive packages are also available to sweeten the deal.

Divi Resorts

Divi offers a collection of laid-back properties in Aruba, including beachfront accommodations at AAA Three Diamond designated Divi Aruba Phoenix Beach Resort and alongside the links at Divi Village Golf & Beach Resort. Both have full-service spas, several pools and a selection of onsite restaurants. For added convenience, all-inclusive options are available at select hotels.

Hyatt Regency Aruba Resort Spa & Casino

One of the many hotels dotting Eagle Beach, the AAA Four Diamond desginated Hyatt Regency Aruba stands out for its relaxing, upscale vibe. With two restaurants, two pools and a spa, you have everything you need for a proper Caribbean reset right on the property, but it’s also close to water sports and activities.

CAN’T-MISS

Explore the artisan workshops and archaeological museum of this recreated 16th-century Mediterranean village perched above the Chavon River. Don’t miss the 5,000-seat Grecian-style amphitheater, which hosts international performers.

Step back in time at the oldest European settlement in the Americas. The UNESCO World Heritage Site features cobblestone streets, colonial architecture and historic landmarks like the Alcazar de Colon – a fortified palace built in the early 16th century, and the Catedral Primada de America, a 500-year-old Gothic-style place of worship.

Take a catamaran or speedboat to this idyllic oasis off the southeastern coast, part of National Park of the East, to discover powdery sand beaches, turquoise waters and natural pools teeming with starfish.

Adventure seekers love this series of 27 cascading waterfalls in Puerto Plata. Follow an experienced guide to hike, climb and jump your way to the falls, as you encounter natural waterslides and pools along the way.

From mid-January to mid-March, witness the spectacular sight of thousands of humpback whales in their natural breeding grounds. Take a boat tour to observe these majestic creatures up close as they breach and sing.

Fun Fact

Dominican Republic is where you can find the Caribbean’s highest peak, Pico Duarte, standing at 10,164 feet above sea level. Hiking to its summit takes two to three days.

WHERE TO STAY

Margaritaville Island Reserve Cap Cana

Although it’s located in Punta Cana’s exclusive Cap Cana community, Margaritaville maintains a laid-back, beachy vibe, offering personalized service without feeling pretentious. Kick back on the world-renowned Juanillo Beach or poolside with live entertainment all day. The resort has its own entertainment village featuring a diverse variety of restaurants, bars and nightlife options.

Sanctuary Cap Cana, a Luxury Collection

Recently modernized, this adults-only, all-inclusive resort boasts spectacular suites and artfully designed lobbies, restaurants and bars, not to mention a first-class spa and fitness center. Guests at this AAA Four Diamond property enjoy easy access to beautiful beaches, water activities and one of the world’s top marinas, as well as close proximity to Punta Espada Golf Club.

Treat yourself at the AAA Four Diamond Eden Roc. Luxurious amenities include guest rooms with private pools, spa tubs and beachfront patios, a full-service spa, gourmet on-site dining options and private beach.

CAN’T-MISS

These magnificent sea cliffs in County Clare stretch nearly 5 miles along the west coast. Rising to about 702 feet, they offer breathtaking views of the Aran Islands and Galway Bay. Visit the interpretive center to find out more about the cliffs’ geology and wildlife.

Did You Know?

The Cliffs of Moher have starred in several famous films, including “Harry Potter and the Half-Blood Prince” and “The Princess Bride.” In the latter, the cliffs served as the backdrop for the Cliffs of Insanity.

This medieval stronghold near Cork is famous for the Blarney Stone, accessed from its rooftop, about 100 steps up. Legend has it that the stone, which is part of an exterior castle wall, will bestow the gift of gab on those who kiss it (while lying on your back and leaning backward holding a rail). Explore the castle’s towers, dungeons and beautiful gardens.

Discover the history of Ireland’s most famous export at this seven-story experience in Dublin. Learn about the brewing process and how to pour the perfect pint, then head up to the top floor for a panoramic city view and toast with a complimentary drink. Cheers!

This 587-mile circular route in County Kerry showcases some of Ireland’s most spectacular landscapes. Drive past pristine beaches, medieval ruins and charming villages, with highlights including Killarney National Park and Skellig Michael.

Visit Ireland’s oldest university, founded in 1592 in Dublin. The campus houses the magnificent Old Library and the Book of Kells, an illuminated religious manuscript from the 9th century widely regarded as Ireland’s greatest cultural treasure.

“My favorite time of year to visit Ireland is in the spring, when you’ll run into fewer crowds and mild weather perfect for outdoor activities, such as golfing or trying your hand at the national sport, hurling. Prices are less in the shoulder season as well, making it a great time to book a stay in a castle.”

WHERE TO STAY

Nestled in East Cork’s vibrant market town of Midleton, this recently refurbished hotel is just a 15-minute drive from Cork City and about 20 minutes from Cork Airport. It serves as an excellent home base for your adventures in and around southeastern Ireland.

Powerscourt Hotel, Autograph Collection

Set on a scenic and historic estate, the Powerscourt Hotel puts you in the center of Ireland’s emerald landscape, featuring on-site gardens, two golf courses and a spa. Located just 30 minutes from Dublin City center, 35 minutes from Dublin Airport and offering complimentary shuttle service to local attractions, getting around couldn’t be easier. For traditional Irish fare, dining is available at Sika restaurant, and afternoon tea is a tradition at the Sugar Loaf Lounge.

The Westbury is a member of the Leading Hotels of the World and was voted best hotel in Ireland by Conde Nast Traveler readers in 2023. Here, in the center of Dublin, guests are surrounded by sophistication and style, complemented by warm and genuine service. Enjoy afternoon tea, craft cocktails and fine dining at the on-site restaurants and bars.

CAN’T-MISS

The Amalfi Coast is a dream come true with its sheer cliffs, azure waters and rugged shoreline. Picturesque towns like Positano, Amalfi and Ravello line the coast, luring visitors with exquisite seaside views and gorgeous beaches. Sample fresh seafood and local specialties, like limoncello, a popular lemon liqueur. Outdoor enthusiasts are drawn to the region for scenic hiking trails, including the breathtaking Path of the Gods, a mountain trail that hugs the coastline.

Milan’s iconic Gothic cathedral is a must-see marvel. Flying buttresses, soaring spires and exquisite terraces, along with more than 3,400 statues and 135 gargoyles, make this a feast for the eyes. Known as the Duomo, it is Italy’s largest church, even grander that St. Peter’s Basilica in Vatican City. Head to the rooftop to soak in breathtaking panoramas of Milan and the Italian Alps. The museum next door offers a fascinating dive into the cathedral’s construction and history.

This ancient amphitheater, completed nearly 2,000 years ago, once dazzled over 80,000 spectators. Thrilling gladiator matches entertained Roman citizens for more than 300 years. A series of earthquakes damaged the Colosseum to its core, but it was partially restored in the 1990s. Today, people flock here to get a glimpse at the ruins and learn about the fascinating cultural and social dynamics of early Rome.

Florence’s Uffizi Gallery is where you can find one of the world’s most impressive collections of Renaissance masterpieces by such icons as Michelangelo, Botticelli and da Vinci. The gallery itself, with its Renaissance-inspired architecture, radiates the movement’s core ideals of harmony, clarity and proportion, adding to the allure of this world-famous museum. Private and small group guided tours add insight to the artists and their extraordinary works.

Centered around an intricate network of more than 150 canals, Venice is unlike any other city in the world. Take a gondola ride to soak up the Floating City’s striking scenery and centuries-old architecture, with standouts like the Rialto Bridge and sights along the Grand Canal, including Piazza San Marco and Doge’s Palace.

For the History Books

Italy lays claim to 59 UNESCO World Heritage Sites – that’s more than any other country in the world! Among them are the Colosseum, the ancient town of Pompeii, the Dolomites and Venice.

WHERE TO STAY

In Milan’s Porta Nuova district, conveniently situated near several tram stops, the Radisson Blu Hotel provides easy access to key attractions and shopping areas. Guests can enjoy helpful concierge services, an on-site restaurant, a fitness center, an indoor swimming pool, a sauna and a lobby bar, making it a great value choice for both relaxation and exploration.

Located in the peaceful Santa Croce district on a picturesque cobblestone street, the elegantly appointed rooms and modern comforts of this charming Venetian hotel enable a tranquil retreat from the noisy and bustling tourist areas. Plus, it is just a short stroll from the Rialto Bridge, Piazza San Marco and Venezia Santa Lucia, Venice’s central train station.

A stay at the five-star St. Regis Rome promises unparalleled luxury from the moment you step into its opulent lobby. Indulge in amenities such as rooms and suites adorned with exquisite fabrics and elegant furnishings, a full-service spa and the sophisticated onsite restaurant, Lumen. Right in the heart of the Eternal City, guests can easily walk to iconic landmarks like the Spanish Steps and Trevi Fountain.

CAN’T-MISS

This gem has an extensive collection of Louis Comfort Tiffany’s works on display, including stunning stained glass, ceramics and jewelry from the Art Nouveau era, which flourished from 1890 to 1910. The opulent Tiffany Chapel is a highlight with its decorative moldings, carved plaster arches and mosaic columns. Stroll the museum’s galleries and you’ll see why it’s such a cultural treasure in Orlando.

Dive into fun at Discovery Cove, where you can swim with playful dolphins, snorkel among brightly colored fish and chill on pristine white-sand beaches. But that’s just the start. There’s also encounters with tropical birds and sun-soaked floats along winding lazy rivers at this all-inclusive day resort with unlimited food, drinks and snacks. Reef-safe sunscreen comes with admission. Upgrades include private cabanas, premium drinks and photo packages.

Spanning 50 acres, these gardens are a serene escape into lush botanical beauty for all ages. Wander through a notable collection of flowering shrubs, ornamental grasses, azaleas and succulents. There’s even a citrus grove that contains more than 50 types of citrus trees. Themed sections include a butterfly garden and a historic rose garden with more than 650 beautiful roses.

For movie and TV enthusiasts, Universal Studios Orlando is a must-visit. Get transported to the worlds of Harry Potter, Jurassic Park, Minions and more via thrilling and immersive attractions like 4D rides and shows. Character parades and whimsical meet-and-greets add extra fun to your adventure. On extra hot days, cool down at Universal’s Volcano Bay water park.

The world’s most famous mouse reigns supreme in Orlando, so plan to visit at least one of the Walt Disney World theme parks while you are there. Go for rides, shows, character meet-and-greets, food and musical parades. Ticketed seasonal events, like Epcot’s International Food & Wine Festival and Mickey’s Not-so-Scary Halloween Party at Magic Kingdom, add an extra sprinkle of magic to your visit.

Faith, Trust and Pixie Dust

Walt Disney World has rules and guidelines in place to maintain the magic of its parks. Underground tunnels at Magic Kingdom – known as “utilidors” – serve as a backstage. Concealing dance practice rooms, costuming and a staff cafeteria, they help ensure a seamless and truly magical experience.

WHERE TO STAY

Comfort Inn International Drive

This hotel is an excellent option for relaxation and convenience without breaking the bank. Its prime location is within walking distance of attractions including the Orlando Eye Ferris wheel, Madame Tussauds wax museum and family-friendly restaurants. Start the day with a free breakfast and unwind by the outdoor pool.

A stay at the Grove Resort is a win, especially for families, thanks to its complimentary on-site water park and free shuttle service to nearby Walt Disney World. Spacious, condo-style suites provide a home-like feel with full kitchens and separate living spaces. The AAA Three Diamond hotel also has two poolside snack bars, three restaurants and a coffee shop. Set on picturesque Lake Austin, swan paddleboats or kayak rentals are available to take out on the lake.

Escape to the AAA Four Diamond Waldorf Astoria Orlando and indulge in award-winning dining, a world-class spa and an 18-hole championship golf course. Take the shuttle to Disney or enjoy a day by the pool, complete with private cabanas. Waldorf Astoria Kids Club keeps kids ages 5 to 12 entertained, allowing adults to sneak away for a private, romantic dinner.

CAN’T-MISS

Welsh heritage is on full display at this stunning castle in central Cardiff. From Roman fort to Norman stronghold to Victorian Gothic revival mansion, Cardiff castle showcases over 2,000 years of history. Don’t miss the opulent interiors and fascinating wartime tunnels.

Perched atop an extinct volcano, this majestic castle dominates the skyline of Scotland’s capital. Explore its rich history, see the Scottish crown jewels and enjoy panoramic city views from its ramparts.

Discover the natural wonder of Northern Ireland’s coastline at this UNESCO World Heritage Site, featuring around 40,000 interlocking basalt columns resulting from an ancient volcanic eruption. Walk along the distinctive hexagonal formations and hear about local legends at the visitor center.

Marvel at this prehistoric monument on Salisbury Plain in Wiltshire, England. The mysterious circle of standing stones has captivated visitors for centuries. Visit the exhibition and visitor center to find out more about its construction and significance.

Delve into nearly a thousand years of history at this iconic fortress on the Thames River. Home to the Crown Jewels, the White Tower and the famous Yeoman Warders (Beefeaters), the Tower offers a fascinating glimpse into royal history and intrigue.

Literary London

Follow in the footsteps of famous authors with a literary tour of London. Visit the Sherlock Holmes Museum, at 221B Baker St., explore Charles Dickens’ former home, now a museum, or have a pint at The George Inn, frequented by Shakespeare and Dickens.

WHERE TO STAY

Experience a warm Welsh welcome at this unforgettable retreat on the picturesque Cardiff Bay waterfront. Among its many perks, this landmark hotel boasts exquisite dining and the award-winning Spa at St. David’s, along with easy access to Cardiff’s city center and serene countryside.

art’otel London Battersea Power Station

With colorful interiors designed by award-winning artist Jaime Hayon, this vibrant hotel in London’s Battersea neighborhood is a perfect blend of art, design, convenience and hospitality. Go for the chic rooms and suites and state-of-the-art gym and spa. You also won’t want to miss the breathtaking rooftop pool, in-house art gallery and top-rated dining options.

Sheraton Grand Hotel & Spa, Edinburgh

Experience Scottish luxury, ideally located next to Edinburgh’s UNESCO World Heritage City Centre – some rooms even have views of Edinburgh Castle. After a day of sightseeing, go to One Spa, Scotland’s most renowned urban thermal spa experience. Stay in a club room for complimentary access to the club lounge, including evening drinks and canapes.

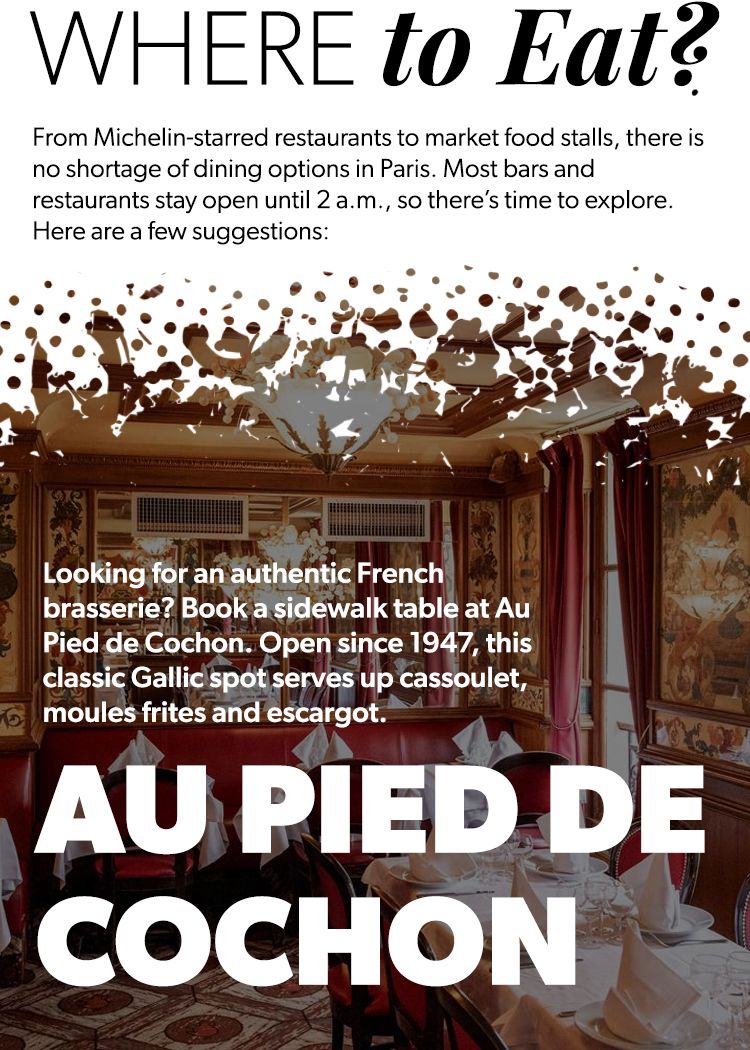

RESOURCES