Applying for a mortgage loan can be a dream come true or a real wake-up call. The difference is how well you prepare.

Getting your ducks in a row before applying for the biggest loan of your life is important if you want homebuying to be the wonderful experience it should be. It’s not something you can do overnight, either.

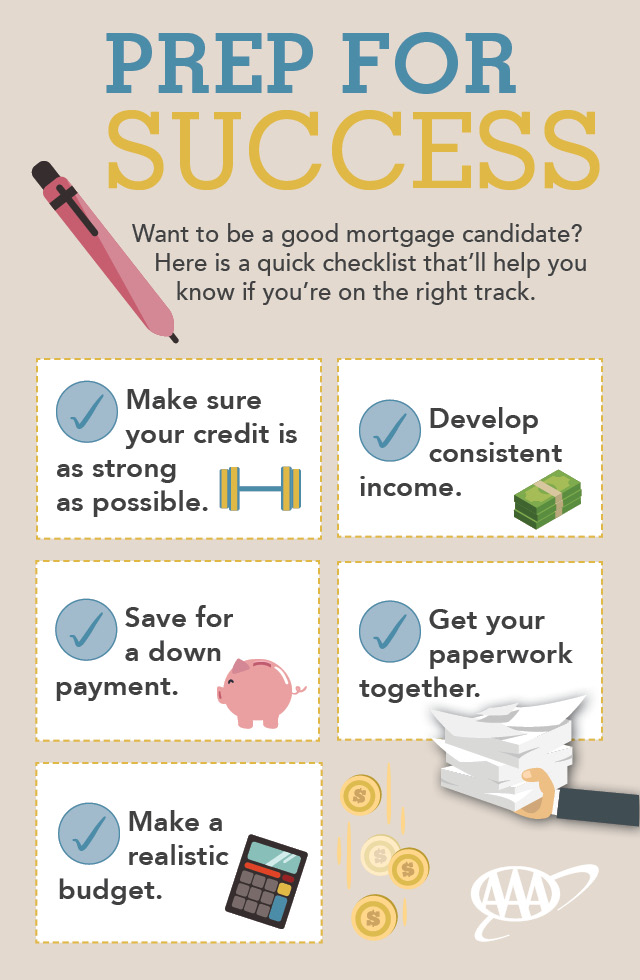

Becoming a quality mortgage candidate is something that can take years. Here are some of the steps you should take.

Have a Good Track Record

One of the best ways to show you’re prepared for a mortgage loan is through strong credit. The basic principles of building good credit are: always pay your bills on time, be careful about opening and closing new lines of credit and don’t use a high percentage of your available credit.

A good way to know how you’re doing is to review your credit report. Every consumer is entitled to a free copy of his or her credit report once a year from each of the nation’s three leading credit repositories. Click here for details on getting your report.

Scores Aren’t Everything

Credit scores are numbers that help tell lenders how likely borrowers are to consistently make loan payments. There are some credit card companies that offer customers free access to their scores. It’s important when reviewing these scores to remember that there is no single credit score.

FICO is one of the most popular credit scores, but it might not be the figure a lender is using to determine your credit worthiness. Lenders use a variety of algorithms to determine applicants’ credit scores, and they can vary depending on the type of credit you’re applying for.

Think of your credit score as more of a ballpark estimation of your credit worthiness versus a cold, hard figure.

Having a low credit score can have varying degrees of consequences. If your credit is too low, your mortgage application may be denied. If your credit is good, you may be approved but at a higher interest rate than someone with excellent credit. Some credit scores may also limit your eligibility for loan programs. Mortgages through the Federal Housing Authority, for example, tend to have lower credit thresholds than traditional mortgages.

Work It

A steady income goes a long way toward proving you’ll be able to make payments on your mortgage loan. Applicants with consistent work histories often fare better than those who have recent gaps in their work histories.

Be Realistic

Don’t overextend yourself. Lenders typically will allow your monthly debt to go up to 43% of your gross monthly income. But consider your lifestyle. If you have upcoming expenses like college for a child or possibly a new car purchase, you may want to dedicate less toward a mortgage payment.

Save, Save, Save

Borrowers who make large down payments are often seen as lower risks than borrowers who make small down payments. In fact, homebuyers who aren’t prepared to put 20% down should be prepared to pay for mortgage insurance. It’s a fee often added to your monthly mortgage payment like homeowners insurance, and it protects a lender in the event a borrower defaults. If you don’t think you can put aside even a small down payment, like 3.5%, you may be eligible for a government-insured mortgage program that permits relatives to gift you money for a down payment.

Get Organized

You’re going to need quite a few documents to close on your mortgage. Getting all your paperwork together as early as possible can help. Have at least have two or three recent paystubs, tax returns from the last two years and bank and debt statements.

For faster, more personalized service to secure your mortgage, consider using a mortgage broker with AAA.

Learn more about AAA mortgage loans and other home loan services.