For most of your working life, retirement can feel almost theoretical. But then, all of a sudden, it’s time for you to retire. Are you even ready for retirement? And when exactly is the right time for you? Retirement needs to last for the rest of your life, so you have to consider your future! What do you want your quality of life to be?

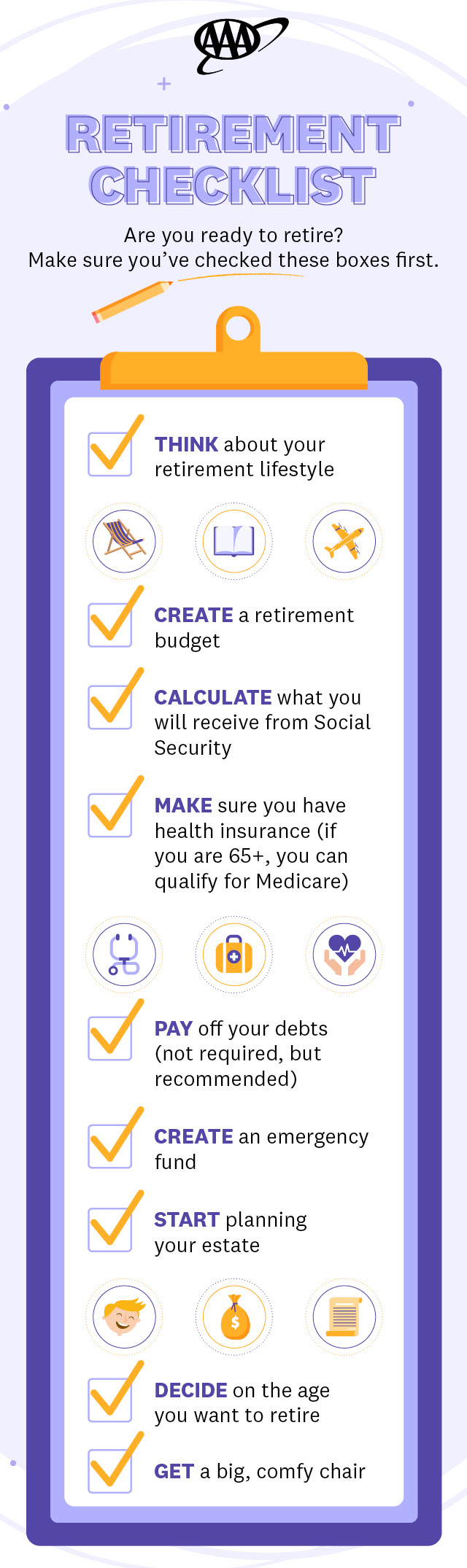

The age at which someone is ready for retirement can vary greatly depending on how much they’ve saved up, what they want their retirement lifestyle to look like, whether they have outstanding debts or even how much they enjoy their current job. Retirement always sounds good, but it’s not always the right time to retire – especially if you’re not prepared. Check out this checklist to learn how to know if you’re ready to retire.

Think About Your Retirement Lifestyle

This is one of the most important things to consider when deciding if you’re ready for retirement. What do you want to do with your retiree years? Do you want to travel the world? Play golf every day? Move to a warmer climate? Or move closer to your family? Consider how much these things will cost and plan accordingly. Don’t limit yourself – just try to save enough so that you can live your retirement dream in comfort. You can’t save for something that you’ve never even thought of.

Create a Retirement Budget

Once you have decided on what your retirement lifestyle is going to look like, you can create a prospective budget for those years. Considering that you’ll most likely be on a fixed income in retirement, you need to know what you’ll be spending your money on. Start by calculating the budget that you currently live on, then apply that to the ways your life might change in retirement. Create a monthly budget that you might be able to live on post-retirement and test it out for a little while to see if it works for you.

Be mindful that you may have new expenses as you age. You might need to remodel your home to be more accessible or employ a home care aide. Or (on the brighter side) you might pick up a new hobby that you never had time for in the past.

Calculate What You Will Receive From Social Security

If you want to be ready for retirement, you need to know what you’ll be getting through Social Security. Social Security will likely not be your only source of retirement income, provided you have a pension, 401(k) or another savings plan. But Social Security is an important piece of the pie.

Social Security is a complex system that takes into account how much money you have earned, when you were born, the credits you have accumulated and more. Do a deep dive into the inner workings of Social Security if you are serious about retirement.

Currently, you cannot claim retirement benefits from Social Security until you are 62 or older – and the longer you delay your retirement, the bigger the benefits (though the benefits max out at age 70). If you wait to claim Social Security until your “full retirement age,” you’ll get the full benefits you are entitled to every month. If you were born in 1960 or later, your full retirement age is 67.

To calculate what you will receive from Social Security, check out this official Social Security calculator. It’ll make the question of when to retire a lot easier to answer.

Make Sure You Have Health Insurance

Before you retire, you need to make sure your retirement health insurance is taken care of. You might be able to continue with the health insurance that you already have, but there is a chance that it could change in retirement. Speak with your health insurance provider to double check. If you are 65 or older, you can qualify for Medicare.

Pay Off Your Debts

This step isn’t necessarily required, but it does make retirement a whole lot easier. Being on a fixed income does not make it easy to pay off your debts. And who wants to be worrying about debt in retirement anyway? Aren’t you supposed to be golfing or something?

Your debt should retire before you do. It might be worth it to work an extra two or three years if it makes the difference between retiring with debt and retiring debt-free.

Create an Emergency Fund

You never know what could happen – and retirement is supposed to last you for the rest of your life. Having a financial buffer to protect you from unexpected costs can prevent you from unexpectedly sinking into post-retirement debt (which, based on the point above, we want to avoid).

Put your emergency funds in a high-yield savings account, and make sure you can access it quickly and easily. You’ll be thankful when you need it.

Start Planning Your Estate

Ghoulish, I know. But planning for retirement means planning for the future, no matter how hard it can be to think about.

It is possible to write a will yourself, but it will probably be easier and more comprehensive if you hire an estate planning attorney to help you. Do you want a will or a revocable living trust? Your attorney can help you decide.

In planning your estate, you should not only be thinking about what’s going to happen after you die, but what’s going to happen in the late stages of your life. Your children or other loved ones should know what you want even if you lose the ability to communicate with them. Make sure you have a disability plan, appoint a durable power of attorney and create a personal health care directive. Your estate planning attorney should help you with these things as well.

Decide on the Age You Want to Retire

Once you have everything else in your retirement checklist checked off, you can finally decide on the age you will be ready for retirement. Make sure to take all of the aforementioned variables into consideration before making your choice!

Get a Big, Comfy Chair

Get yourself a nice chair. You earned it!

When are you planning on retiring? If you’re retired already, how did you know it was time? Let us know in the comments below!

Learn more about how to save at AAA.com/Financial.