Navigating your career takes more than just doing great work — it takes courage, strategy .

Whether you’re looking for job interview tips or salary negotiation strategies for that long-overdue promotion, this episode offers actionable advice to help you overcome imposter syndrome, own your voice and take up space without second-guessing yourself.

READ MORE

[00:05:03] Sabrina Pierotti: I love that. And now I want to go into the actual interview process, like, getting your foot in the door, which is a whole task in itself. There’s the job, but then there’s also getting the job. And I want kind of address the elephant in the room, which is AI. That is a part of every aspect of our life. It’s not going away. And, of course, now, it’s a part of the recruiting process. So, from what I understand, and correct me if I’m wrong, Sam, but before your resume gets into a human recruiter’s hands, an AI bot literally scans your resumes. So, there is a high likely chance that your resume, no matter how hard you worked on it, is not going to get in front of the eyes of a human person.

[00:05:50] Sam DeMase: Yeah, this is such a timely question, such an important topic, and I talk about this a lot in my work. You got to make AI your ally at this point. This whole rise of AI reminds me a lot of the early days of the internet. When the internet was first coming to be and people were scared, we had the whole Y2K scare, people were afraid, is this going to take away jobs? Is this going impact my livelihood? Does this mean I don’t have privacy? I think it’s about leaning in, not being afraid and using it responsibly and using it as your ally, because to your point, if employers are going to be using it to screen us, we need to be using it as well to our advantage in the process. And there are really good ways to do that. So, you mentioned, like, the bot that scans mid-size and large companies use to filter through resumes to look for certain keywords. And there are ways you can proactively make sure your resume is going to make it past that screen and get to a human. And we do that through tailoring. So, when you take a look at a job description, you take a look at your resume, one way you can use AI to make sure you’re properly tailored is go into your favorite AI, copy and paste the job description. Copy and paste your resume, and enter a prompt, something along the lines of, can you tell me what my gaps are between this job description and my resume? What experience, keywords, skills, certifications, or education gaps do I have? AI will tell you, be direct, and will say that these are your gaps. Obviously, double check it. AI is your thought partner, not your final answer. It will also reveal if you’re applying for the right jobs, if your prompt reveals all these gaps, you’re probably applying for the wrong jobs. So, take that into account, but it will help you see any gap areas you have where you can then go back in your experience and fill those in.

[00:07:36] Sabrina Pierotti: So, say that you just kill the resume, and they’re like, we need to meet this person. And I’m literally like getting sweaty palms just thinking about it. How do you approach an interview?

[00:07:50] Sam DeMase: It’s about preparation. Like 99% of your interview success is in the prep. I recommend the WAT method, W-A-T. It stands for what you do, achievement, and tie in. And for me, I’m somebody who used to be a recruiter, used to be a hiring manager, I know what they’re looking for. They are not looking for you to tell your whole life story. They are not looking for you to walk through your entire resume, which is what a lot of candidates do, because of nervousness, that we start to ramble. It needs to be concise. It needs to be a powerful short story. So, you’re going to quickly say what you do, how many years of experience you have, your top achievement from your last position that’s related to the role you’re trying to get, and then, tie it all back. So, for example, you could say something like, yeah, absolutely, here’s a little bit about me. I’m a training and development manager. I have 10-plus years of experience in building curriculum, teaching live classes and elevating culture and people operations at mid-size organizations. In my last role, I increased training completions by 40 percent in the first six months. And I know in this role, you’re looking for somebody who can do that. So, I’m really excited to bring my expertise to this position. And you pivoted right back to talking about the role, and then you set them up to ask you your first interview question. So, it really is about an elevator pitch, and it makes you appear super confident. It makes you a peer really, really connected to your superpowers. And it makes the interviewer really excited to engage with you. So, I recommend using that method to kick off your interview on a really, really positive note.

[00:09:19] Sabrina Pierotti: I want to talk about signs in an interview. Because as much as the company is interviewing you, you also are interviewing the company. And this is something that I wish I really understood or took to heart when I was interviewing for jobs, but I get it. Like, when you are trying to find a job, you’re desperate. You just want a job and a paycheck. So, I 1,000% understand that. But at the end of the day, you are going to be spending more time with your co-workers than you are your dog or your spouse. You’re going to be spending so much time at this company.

[00:09:55] Sam DeMase: So, if you are going through the interview process, starting from the recruiter to the hiring manager, to the panel, to the peer interview, to the executive leadership round, because these days there’s usually four or five or six rounds, is their disinterest, disengagement a pattern? Do you notice this across the team, or was it just one-off from one person? Disorganization, if that’s a pattern across the organization: in the emails you’re getting from them, they’re canceling interviews, they’re rescheduling on you, they’re consistently showing up unprepared or looking at their phone or disengaged. That is a huge red flag, is the pattern of that. Now, if it’s a one-off one person, it’s little hard to say. But if you think about it in concert with all the things I’m going to talk about, it all adds up. So, pattern is one. Another one is how do they respond to your intentional questions? So, if you miss an opportunity to ask them intentional questions, you’re not doing your due diligence of making this a conversation and investigating what they’re about. So, I always recommend asking the hiring manager really smart, pointed, curious questions because this does two things. It shows that you’re a curious and interested candidate who is ready to tackle this role tomorrow. So, it shows them that you are ready. And two, it gives you valuable essential information as to whether or not you want this job. So, I also ask in an interview, can you share an example of how work-life balance manifests on this team? What does that look like in practice? I always ask, can you share an example of someone you developed and promoted on this team? What did their path look like? Because I care about upward mobility. I will always ask, can you show an example of how you have evolved as a person since starting here? Questions about the things that matter to you in a workplace culture. Ask those questions, get those answers, and see if you’re aligned. And then the last piece is your intuition. If your intuition is screaming at you that this is a bad idea, you didn’t connect with those people, you felt put on the spot. Also think if an interview feels like an interrogation, that is a huge red flag. Interviews are a conversation, not an interrogate, I always say. So, if you feel like you were sitting back and they were just firing questions at you, definite red flag, listen to your intuition. So, between those three things, the pattern, is this a pattern? How did they respond to my pointed curious questions and my intuition? Those three things will help you figure out is this opportunity right for me.

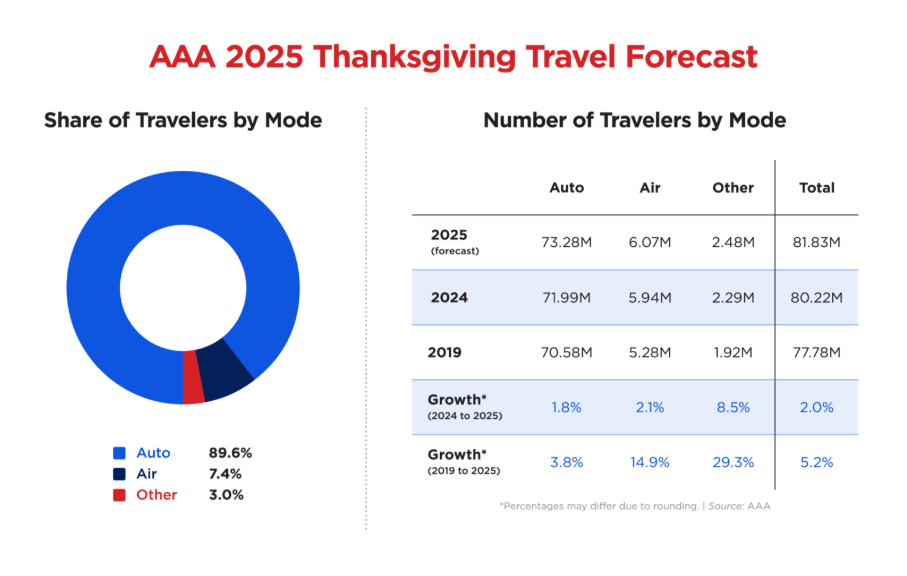

[00:11:49] Sabrina Pierotti: Speaking of being prepared, a AAA membership might be the most valuable tool in your toolkit. Roadside assistance, insurance, loans, big discounts on things you use every day, travel packages, and so much more are yours when you’re a AAA member. With levels to suit your lifestyle, AAA is there for you. Check out AAA.com for more information.

[00:12:13] Sabrina Pierotti: OK, so we crush the interview, we like the company, we feel good, we get the job, and we’re like driving up to the office. They’re going to want to prove themselves from Day 1. And that’s also something I wish I told myself back in the day was, don’t try to prove yourself from Day 1. Sit back for a while, let other people shine around you and learn and absorb and like, you’re going to have your moment. What is your advice for setting healthy boundaries at the end of the day?

[00:13:18] Sam DeMase: This is such an important topic, and I feel like sometimes people who are young in their careers think that boundary setting is off the table for them. However, it is not the case, especially in today’s workplace. Boundary setting is accepted. However, the burden is on us as the employee to set those boundaries, and that is the most important piece of this conversation. Your employer will never offer a boundary. You have to be the one to bring that to the table. Your employer will push the envelope and push you and push you until you burn out, until you hit a stopping point. That is, unfortunately, the reality. It’s actually great to do it when you are new, because it’s harder to establish boundaries once you’ve gotten into a different dynamic with your manager. It’s then hard to then go back and reset those. So, I actually recommend setting them from the jump early on. When you first start a job, I always recommend walking in knowing what your boundaries are. So, first step is write down what your boundaries are. Do you know your own boundaries? When I first started my first job, I had no idea. I’m not comfortable receiving emails at 8 p.m. and thinking that I need to respond to those. There were certain things that would come up, and I would realize, maybe this is a boundary. So, as soon as I figured out what my boundaries were, I codified them, wrote them down, and then I was able to start communicating with my manager about what those are. For example, I had somebody set up a meeting with me at 6:30 p.m., and I just responded and said, hey, I’m wrapping my day at 6, but here are some other alternative time slots that I can meet, and they easily just changed it to another time. So, be solution-oriented, set your boundary, be firm, and just be clear about it. That comes to workload as well. If you are maxed out on workload, you need to tell your manager: hey, I’m currently maxed out with projects A, B and C. Can you help me re-prioritize some of this if you’d like me to take on project D as well? You have to be very vocal and very clear. If you stay silent, they’re going to just assume you can do more and more and more and more. So, you do have to be the one who owns that.

[00:15:27] Sabrina Pierotti: Now, what would you say to somebody who has been at a company for a couple years, feels like they’ve really made an impact, and they want either a promotion or a raise? Like, how does somebody prepare for a very intimidating conversation like that?

[00:15:42] Sam DeMase: Advocating for yourself, getting that raise, there is a system to it. There is a method to the madness, which is, I feel, not spoken about as much. I didn’t know about this until I was mid-career, but in order to ask for a raise and a promotion, you need to write a business case. We call it an HR behind the scenes. A business case is a three-step process, one is your role-related achievements. So go back and look at your job description line by line and write down what you’ve achieved in each category, how you’ve responded to your goals, how you made progress on things that you’ve done since the beginning of the role versus now. So, yeah, all your achievements that are related to the role is No. 1. The second piece of your business case is ways that you are working beyond the scope of your current job. Which, if you’re ready to get promoted and you feel like now’s the time, you’re definitely doing things that are not on your job description. So, go ahead and list all of those things out. That’s part 2. And then part 3 of your business case is feedback from colleagues, leaders, vendors, clients, collect all of that. And again, I recommend putting that on your brag sheet throughout the year, so that way, when it does come time to advocate for yourself for a raise, promotion, performance review, discussion, whatever it may be, you have all of your evidence, you have all your wins. There’s nothing like showing up to advocate for yourself with a whole rock-solid case. It’s harder to show up and just say, I believe I deserve a reason of promotion because so-and-so has it and I work harder. That is never going to work. At the end of the day with your boss, because your boss needs to have evidence to advocate you. And when you are done presenting your business case to your boss, my favorite line to use is, will you advocate for me to make this happen? Will you advocate for me to make this promotion and raise happen? Because that shows your boss immediately that you’re on the same team. This isn’t about you trying to take their position. You are not a threat to them. You and your boss are on the same team, and you’re putting them in a position to advocate for you. So, you say to them, will you advocate for me to make this happen? Their response to that is very telling. And it is just for me the perfect way to end that conversation and to bring it from, all right, I presented my case. Now the ball is in their court. Where is this going to go from here?

[00:17:55] Sabrina Pierotti: I love it, that’s why you’re great at what you do, honestly, and I needed that 10-plus years ago, I still need that. I love that, that’s awesome. What if we do ask for something huge and somebody says no, like rejection sucks. Nobody likes feeling whether you don’t get that job you interviewed for, or you asked for that raise, or that extra money on a contract, and they said no, where do you go from there?

[00:18:22] Sam DeMase: It’s hard, and it’s important to acknowledge that it is hard, and rejection can feel like a setback, but I always say rejection is protection. Whatever you’ve been rejected from, there’s a reason. This rejection protected you from something. Maybe it was going to be a toxic opportunity. Maybe it’s going to lead to burnout. We all go through that. It is a universal experience with rejection. So, I recommend talking about it. Have a vent. Vent to your therapist, to your best friend, to a co-worker you trust, you know, you can have a vent conversation about it. Rejection loses its power when we talk about it, just like imposter syndrome. You have to name it to tame it. So, once you’ve named it and said, I’ve been rejected. This is what happened. It will lose its power.

[00:19:06] Sabrina Pierotti: So, before we wrap up, I just want to talk about myths. So, what is a workplace myth or rule at any part of the process? Interview, once you’re in the job, that just needs to go away. It shouldn’t be there.

[00:19:23] Sam DeMase: This is a great topic of discussion. I would say, one that needs to die is put your head down and work hard, and you’ll get rewarded. That is no longer the case. Put your head down and work hard. My parents told me this. Yeah, just put your head down, work hard, you’ll get recognized. That did not work. I tried that in the beginning of my career, and all that did was lead me to burnout, frustration, anger, jealousy. It leads to a lot of hard things. So, instead of putting your head down and working hard silently, do the opposite. Advocate for yourself, be loud about your achievements, vocalize your wins. It’s going to feel weird at first, and then it’s not. It will be hard at first. But there’s small ways you can celebrate your wins, like for example, anytime I got positive feedback at work, I would just forward the email to my boss and be like, hey, this made me smile today, check out this win. That’s a great way to start that pattern of self-advocacy and to highlight that your work is impactful. If you don’t do that, your manager has no idea. Your manager’s going to have no clue. They’re wrapped up in their own world, No. 1. They are busy, and they’re not going to know what your impact is unless you tell them. So, it’s really important to start doing that in small ways like that.

[00:20:38] Sabrina Pierotti: This was awesome, Sam. People listening just need more of Sam and have questions for you or need your help interviewing for their next job. Whatever it may be, they want to get in touch with you. How can they do that?

[00:20:52] Sam DeMase: Absolutely, I would love to stay in touch. You can find me on Instagram @apowermood, or at APowerMood.com, where you can sign up for my free newsletter, or you can buy my book, “Power Mood,” and learn how to advocate for yourself every step of the way in your workplace journey.

[00:21:07] Sabrina Pierotti: Thank you so much. I hope people listening who are either going through a challenge at work or interviewing for a new job, I hope that this just gave them that breath of relief that they were looking for. So, thank you so for your time. It was awesome chatting with you.

[00:21:24] Sam DeMase: Thank you so much for having me.

[00:21:28] Sabrina Pierotti: What an awesome episode, thank you so much, Sam, for joining me in this conversation today. I really appreciated the reminder that confidence is a choice, that we have to make every single day, whether it is setting boundaries, advocating for ourselves or just asking for help when we need it. So, if this episode resonated with you, please be sure to follow, rate and review Merging Into Life wherever you’re listening. It really helps us reach more people and keep these conversations going. So, thank you so much for listening, and we’ll see you next time on Merging Into Life.

The views and opinions expressed in this podcast are not necessarily the views of AAA Northeast, AAA and or its affiliates.