Do you know all the parts of your car?

Related Articles

Trending Articles

NEWEST ARTICLES

Subscribe to Your AAA Newsletter

Sign up and receive updates for all of the latest articles on automotive, travel, money, lifestyle and so much more!

Do you know all the parts of your car?

Moving into a new apartment or rental can be a project. You have so much furniture, clothes and knickknacks to move into your new place. But once you’re settled, how do you know your belongings will stay safe? You might not think you have expensive things, but could you afford to replace all of them at a moment’s notice? That’s where renters insurance coverage comes in.

To learn more about renters insurance coverage and AAA renters insurance, we spoke to Jodi Desantis, vice president of insurance sales for AAA Northeast.

If you live in an apartment or other type of rental, renters insurance is a way to cover your personal possessions and your personal liability. “Many apartment complexes require their tenants to have renters insurance,” said DeSantis. “And also for them to carry certain liability limits.”

Your landlord is already paying the property insurance, but if you want your personal belongings to be protected, you’ll need to have renters insurance. Renters insurance coverage provides protection for personal items in the event they are stolen or damaged, as well as personal liability in case someone is injured at your rental and you are held liable.

Renters insurance can cover items damaged by fire, lightning, smoke damage, vandalism and windstorms. And if your apartment becomes damaged in one of these events and you can’t stay there while it’s being repaired, it will usually cover additional living expenses, as well. It will also cover you against damages caused by others in your building that you can’t control, like if someone starts a fire in another apartment.

Additionally, renters insurance may protect you from issues that arise from water and sewage backup. “Depending on what you’re renting, typically the flood insurance is purchased by the property owner,” said DeSantis. “Renters insurance covers water damage that originated inside the house, like an overflow or a collapsed sewer line.”

Review your policy terms with your agent to see exactly how you are covered.

Renters insurance obviously covers the personal property you keep in your apartment, but it also travels with you, which could come in handy in ways you might not even realize.

If you play golf, for example, and your expensive golf clubs get stolen from your car, your auto insurance wouldn’t cover the theft, but your renters insurance would.

This is also the case for personal liability. “It looks just like liability coverage with a homeowners insurance policy,” DeSantis said. “So if you have $300,000 worth of liability coverage as part of your rental policy, that coverage follows you. If you were to inadvertently injure someone and you were held liable, even if the incident were to occur outside of your apartment or almost anywhere, you would be covered.”

“Like all property or dwelling insurance, there’s general coverage for your personal property up to a certain limit,” DeSantis said. “That’s something you would have to talk to your agent about … If you have exotic items or anything you might place a lot of value on that you’re not sure about, you should just ask. Whether it’s artwork, firearms or jewelry, most carriers will offer some sort of endorsement that you’ll have to pay an extra premium on to get coverage.”

Learn more about jewelry insurance offered through AAA.

A great way to get the most out of your renters insurance coverage is by taking inventory of all your personal belongings. This can be as simple as making a home inventory video on your phone. Having this record and updating it as needed can help you keep tabs on exactly what you own and the condition of your items, which can be especially handy when making a claim. To keep track of more expensive items, it is also a good idea to hold onto your receipts by taking photos of them or storing the hard copies in a safe place.

If you have any questions, don’t hesitate to ask your insurance agent about any part of your policy.

Learn more about AAA renters insurance.

Do you have renters insurance coverage? Has it ever helped you through a sticky situation? Share your story in the comments section below.

This article has been updated and republished from a previous version.

Many Americans still have reservations about trading in their gas-powered car for a fully electric vehicle. Whether it’s range anxiety, concerns about charging or simply fear of the unknown, some are turning to car rental companies to take the EV life for a spin and see if it’s right for them.

Car dealerships don’t always have unsold EVs on the lot available for test drives, so people are getting their feet wet by renting EVs for short road trips or to putter around town on the weekend. Driving an EV with no long-term commitment and minimal up-front cost or sales pressure is appealing to folks either on the fence about EVs or planning to buy one in the future.

“Renting is a great way to test drive an EV and experience all they have to offer,” said Laura Smith, Executive Vice president of Global Sales and Experience for Hertz.

AAA research has shown that one of the best ways to ease concerns about range anxiety and charging infrastructure is to literally put people in the driver’s seat, and Hertz is happy to help.

The booking process is just like renting a gas-powered car. After selecting the EV option, a renter can choose the model they’d like. Once the reservation is made, the experience differs.

To ease first-time EV renters into the drivers’ seat, Hertz sends a series of emails tailored to the specific vehicle that go over the basics as well as what to expect in terms of the quieter ride, performance, how to shift into gear or park, what regenerative braking is all about, and so on.

The emails are rich with links for deeper dives into the particular EV’s quirks, such as how to engage with climate controls, how to turn on the hazard lights, or what everything displayed on the instrument cluster means.

“In addition to a knowledgeable staff who are well-equipped to assist our customers, we provide a variety of information and resources on how to drive and charge an EV, so people feel comfortable and confident when hitting the road,” Smith said.

Perhaps the most important topic on the minds of EV tryers is how — and where — to charge an EV. While Hertz only requires rented EVs to be returned with at least 75% battery life remaining, many renters hope to try out charging, in addition to EV driving. Hertz offers detailed explanations on how to charge each model in its fleet in addition to finding public charging locations using in-car systems. The company even gives a thorough explanation of the differences between Level 1, Level 2 and fast charging.

Based on the emails and resources on the Hertz website, an EV renter will get a thorough education on EVs and EV charging even before they get in and buckle up for the first time.

So, if you’re interested in driving an EV but don’t know where to start, a rental might be the perfect way to get up to speed with EVs.

AAA members can save up to 20% on Hertz rentals.

You might know your local AAA branch as the place to go to meet with travel advisors and insurance agents, but that’s not all. Our branches offer a list of AAA services that make it easy to take advantage of all your membership has to offer, helping you save time and money.

Here are some of the lesser-known AAA branch services you can find at one of nearly 70 locations throughout the Northeast.

Renew your license or vehicle registration, get a REAL ID and more at our branches in Massachusetts, Rhode Island and downstate New York. Just make sure to make a reservation online first and bring all necessary documents with you. You can apply at certain AAA branches and receive a paper temporary document until your plastic credential is mailed to you. In Massachusetts, Rhode Island and New York, DMV/RMV services are free for all AAA members. In Connecticut, AAA members from outside AAA Northeast territory pay $6 for DMV services and non-members pay $8. While you are there you can even get an E-ZPass. Just check the branch website beforehand to see which services it offers.

Did you know that your pet is a AAA member too? Pick up a free ID tag for your furry friend. Each tag will have a serial number registered to their owner’s AAA membership. If they get lost, the person who finds them can call our 24-hour call center, and AAA can contact the owner. We also offer our branch locations as the venue for such pet reunions, as long as they’re during business hours.

Free notary service is available to members at select AAA branch locations for most documents requiring notary public certification.

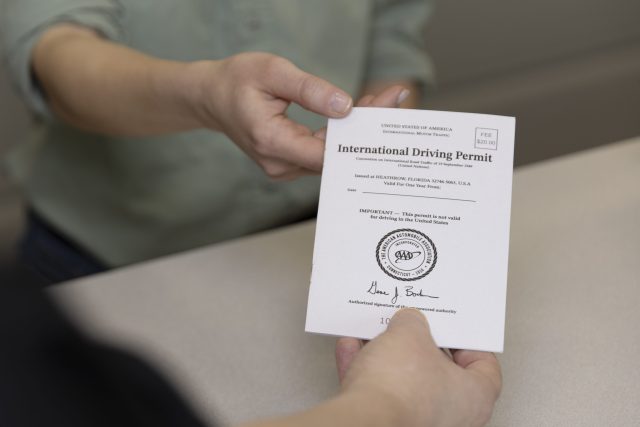

Dreaming of driving through the Tuscan countryside? You’ll need to get a international driving permit (IDP) first. Thankfully, it’s as easy as visiting your local AAA branch and paying a small fee. AAA is the only authorized IDP provider in the U.S. To learn more about driving abroad, listen to our podcast episode.

Sometimes it seems impossible to take a good passport photo that’s also compliant with all the many passport rules and regulations. The U.S. passport photo requirements are strict about sizing, background, wardrobe and even facial expressions.

AAA offers passport photo services at all branch locations, making the process much easier for AAA members. Let us worry about the rules so you can focus on looking good. AAA members get free or discounted passport photos depending on their membership level.

Tired of waiting in line at airport security? Whether you’re a constant traveler or someone who flies once in a blue moon, those lines can grind any trip to a crawl. If you’re looking for fast security lines with less hassle, you should consider TSA PreCheck.

TSA PreCheck is a service that offers expedited security lines at many major U.S. airports, but you have to get it before you go on your trip. You can schedule an appointment for a background check and fingerprinting at select AAA branch locations. You will need a major credit card, bank check or money order to pay the fee. A scheduled appointment is required.

If you’re traveling to a foreign country, it’s always a good idea to have some of the local currency with you. Fortunately, you can get your cash before you go with foreign currency exchange at AAA Northeast branch locations.

AAA Northeast members who are in good standing for one or more years can use a personal check to purchase foreign currency up to $3,000 at a time. When using cash or a debit card, you can purchase even more. You might have to wait some days for the currency to be shipped to you, so make sure you plan ahead.

For all these services and more, visit a AAA branch location today.

Did you know about these AAA branch services? Let us know in the comments below.

This article has been updated and republished from a previous version.

You’ve graduated with your undergraduate degree, and now you’ve decided to go to grad school. Great! Congratulations on taking the next step in your education. You’re almost on your way to a graduate degree — but first, where to? The college search process begins anew.

All rhymes aside, if you’re not going to pursue a graduate degree at the same college that you completed your undergraduate degree, it is like starting the whole process over again. But instead of deciding which college will help mold your early adulthood, it’s a little different.

The question now is: Which grad school holds the key to your career?

Here are some tips and tricks for navigating the grad school search process, as well as some things to think about when deciding which is the right one for you.

Once you have a list of grad schools, ask yourself the following questions to help you whittle it down.

A school that specializes in your field might be more likely to provide the relevant experience, research and mentoring opportunities that you’re looking for.

Not every graduate degree program will prepare you for the licensing or certification that you’re working toward. Don’t be afraid to reach out to the graduate degree program director to clarify any questions you have, including whether or not the program will fulfill your needs.

Try to find out — either by perusing the school’s website or by contacting the career services center — what resources and programs the school would have available to you as a grad student. Do they provide career counseling? Resume writing help? Professional skills development? Is there a job placement program?

Grad school costs an average of $43,620 per year. Pay special attention to the cost per credit, per semester, since graduate degree programs vary in amount of credits required.

This goes hand-in-hand with the above question. Grad school can cost a lot, so be sure to find out what kind of financial aid (other than federal loans) is available. What scholarships and grants are there? What fellowships and associateships are there? How much of the cost would they cover?

You may be going to grad school because your chosen career path requires it. But if not, you may be going to grad school because you’re passionate about an art, a cause, research topic or what have you. Will this school allow you to be creative, dive deep into your research or otherwise explore your passion? What tools and funding will they provide?

Before you dive in to your college search, keep in mind that the college you completed your undergrad degree in may waive certain application fees if you choose to pursue your graduate degree there. Check with your advisor or graduate program director to see what perks might be available to you.

Higher education comes with a hefty price tag. Learn how AAA student lending products can help.

Are you in grad school? What advice would you give to someone in the midst of their own grad school search? Tell us in the comments below.

This article has been updated and republished from a previous version.

SEASON 2: EPISODE 2

Episode Feedback

Hosts Julien and Kiersten of rich & REGULAR sit down with Certified Financial Planner™ Eoin McGee to unpack the emotional baggage and financial anxiety we carry around money. Together, they explore why money feels so personal and how our upbringing shapes the way we spend, save and respond to financial stress.

From the psychology behind subconscious spending to answering questions like, “why do I feel guilty spending money?” and the stories we tell ourselves about being bad with money, this episode of Merging Into Life offers a compassionate look at how to talk about money fears and how changing your mindset can help you change your habits.

You’ll walk away with practical to stop worrying about money, build new behaviors and feel more in control of your financial wellness.

Listen to part 1 of Julien and Kiersten’s three-part miniseries on financial futures: How To Talk to Your Partner About Money.

[00:00:01] Kiersten: I think a lot of my childhood memories set me up to understand how to spend money but not necessarily be financially literate in how money is earned and saved and invested. I had lots of opinions on how to spend. My childhood memory around spending definitely starts in the cafeteria. I don’t know if this is true for all kids and my mom would put out our lunch money on the counter, and every day my brother would grab what we needed, and I remember having that first freedom of choice. I would get basically snacks instead of a meal because I could, and then I would come home starving. But I remember that being my first like shopping experience was in my school cafeteria.

[00:00:42] Julien: Yeah, food. Food’s one of the few things parents allow kids to use their own money and spend, and then they punish them for not making wise decisions. Later on, none of that. I grew up in New York in the 1980s, and we were never poor, but we were always right on the edge. Because my mother worked in Manhattan, whenever I would go to Manhattan, you start to see all the big buildings and really start to see the New York City that I think a lot of people see on television, that’s where you realize, oh, that’s where the money is. So the money’s not where we live. It’s over there in Manhattan in the high rises in the hotels. And so my perspective was always a bit shaped by that. Hey everyone, welcome back to Merging Into Life, where we’re teaming up with AAA Northeast to help you navigate everyday life through smart financial conversations. I’m Julien.

[00:01:29] Kiersten: And I’m Kiersten, and today’s episode is all about what’s going on underneath the numbers, because we’re talking about the emotions of money.

[00:01:36] Julien: Now, most of us already know the basics like spend less than you earn, save when you can, but that’s not always the hard part. The hard part is why we don’t do what we know we should. That’s where emotions come in.

[00:01:48] Kiersten: Exactly and for a lot of people learning how to feel differently about money is what made it possible to act differently with money.

[00:01:55] Julien: I think one of the most popular phrases with respect to money is, when you know better, you do better. Which brings me to our conversation today. I had a really great conversation with Eoin.

[00:02:06] Kiersten: Yeah, I’m so sad I missed that conversation, but I really enjoyed listening to the episode.

[00:02:10] Julien: Yeah. Eoin McGee is a financial expert, author of How to Be Good with Money, and the founder of Prosperous Financial, where he offers private financial planning with a focus on long-term holistic strategies.

[00:02:20] Kiersten: He’s known for breaking down the emotional and psychological side of money, from financial anxiety and subconscious spending to reshaping your mindset and building habits that last.

[00:02:33] Julien: Can you start by sharing just a little bit more about yourself and what got you interested in learning about finance?

[00:02:39] Eoin: Yeah, it’s actually quite a personal story. When I was two, my dad had a heart attack, and he had a quadruple bypass. And when I was six, he had another heart attack, and he had three stents put in. And then when I was eight, he had another heart attack, and he had a quintuple bypass, which is five of them. And he was only 48 at the time. And he turned to his doctor and his consultant, his cardiologist, and said 48 years of age, in the last six years, I’ve had three major heart incidents, what am I doing wrong? And his doctor sat back and said, the problem is stress. And the doctor asked him, what’s the biggest stress in your life? And dad sat back, and he wasn’t a financial planner, he had nothing to do with the profession I’m in today, but he was very successful in his career. And he kind of sat back. And he said, sure, I want to give up work, but you know what I’ll do, I’ll see if the finances can decide it for me. So I’ll often see if I can afford to give it up. And it turned out that along the way at some stage, I don’t know in the States what you call it, but in Ireland we would have called it in the 80s, an insurance salesman. That guy had reached my dad and had sold him an income protection policy. But basically what it meant for dad was, because on medical grounds he was being suggested that it gives up work. He was able to give up work, and he was on 75 percent of his wages until he was fit enough to go back to work or he hit normal retirement age, whichever came first. And it did take my dad a little bit of time to get his head around it but at 50 years of age dad stopped working. And he was able to look after his health and he was there for me. He was there and he made my breakfast before school in the morning. He started driving the school bus to the football matches. He sat on the board of the committee, the parents association. He was around, but the point was he was there. Something struck me. And when I finished up in college, I was offered a job in a big insurance company that happened to be the same insurance company that sold my dad the income protection. And I was very quickly drawn to the idea that I want to do for other families, what that insurance salesman did for my family, which gave us extra years with that. So in simple terms, what drew me to this, I just want to make sure people get the most out of their money. And it’s because someone else did that for me or did that for my family.

[00:04:57] Julien: It immediately made me think about my nephew, who is in his 40s right now, who has a long, long list of ailments in this having his own struggles all while trying to support four children. It brought me back to what first interested me in talking about finance and wanting to share our personal stories and everything that we’ve learned. My wife and I to help other people in couples, because more often than not, it is some type of struggle or conflict in their life, whether it’s in their relationships or some kind of familiar situation that forces people to come to grips with their spending and the way that they think about money and the way that manage money. Now you talk a lot about subconscious spending, which I’m really curious to hear more about. Can you just explain what that is, and how can we tell when we’re doing it?

[00:05:44] Eoin: So subconscious, there’s a difference between subconscious spending and conscious spending. And the main difference here is subconscious spending is walking into the shop to get a Diet Coke. And that’s conscious spending, you went in there to get the Diet Coke. Subconscious spending is walking out with a Diet Coke and a bar of chocolate, right? You went in to do something, but when you actually walked out, you go, oh, hold on a second, I’ve got two things here, because somewhere along the line, the marketing department got into your head to say, you like this bar of chocolate, get this bar of chocolate, you need to buy this now, right. And that’s a subconscious spend. And I try and bring it down to the lowest common denomination, because there’s lots of subconscious spends we do. Like, walking by your barista in the morning, that might be a conscious spend. I need my coffee to get my day going, right? But is the fourth time you walk by the barista that day, is that habit or is that a conscious spend? What was the difference? Like, we all have somebody in the office or a friend or a partner, preferably not your partner, right, but somebody who is a nightmare to deal with till they have coffee in the morning. Okay, and I think that’s something that they really need to have. But that person can often say, oh no, but it has to be that coffee from that barista, or I can’t get on with my day. And then all of a sudden, they’re making their coffees at home with pods and doing it all, and they survived it. So there is a thing there about where we just spend, because it’s hampers from where we spend, because it is conscious spending. There’s a really good way of recognizing the difference between the two of them. And the way you recognize it is, I would put a challenge out that don’t change your spending for the next week. Keep your spending as it is, okay? But every time you spend, take out your phone and go into the notes section and write down, Diet Coke, $2.50, whatever the dollars is, right? Bar of chocolate,$ 2.00. Pair of jeans, $100. Drinks with the girls after work, $60 or whatever it turns out to be. But every time you spend money, just spend like you always spend, but every time you spend, I want you to write it down. And this day next week, take out your phone, take out a pen and a piece of paper. This is really important to do with a pen a piece paper. Something happens in our brain when it comes to pen and paper. Just goes in a bit deeper. Okay. So write a line, put a line down the middle of the page on one side of the page, put conscious spending, on the other side of page, but subconscious spending. I want you to take everything from your notes section and put it on one side or the other and remember the barista coffee first thing in the morning might have been a conscious spend but was the fourth one. Some people struggle with this a little bit actually and if you change the headings a little to added value to my life or didn’t add value to my life. Okay and once you’ve got those lists put down and again there are certain things and certain circumstances will add value in your life. So for example I do a lot of travel. When I travel, if I’m traveling for work, like, if I’m speaking at an engagement in the US, for example, and I’m over at a conference and I speak at the conference, I really don’t care what the hotel is like. Provided it’s safe, and provided it’s clean, and provided that it’s quiet and I can sleep, I’m happy with the hotel, okay? When I travel for leisure, I want a nice pool or whatever the circumstance, I want it to be nice, right? So, in different circumstances, different things add different value to us, okay. And what I would say is it’s about trying to just take that week as an example and applying what added value to my life, what didn’t add value to it, what was a conscious or what was the subconscious spend. Because once you’ve done that, and you’ve taught up everything on the right hand column, if that’s the way you’re doing it, everything that’s other than the subconscious or didn’t have value to our life, you can calculate how much money did I spend last week on stuff that added no value to your life. Because guess what? If you strip that out of your life next week, your enjoyment of life is still exactly the same, but you’ve identified $50 or $60 out of $80 that you can now go and put to some use somewhere else, whether that’s saving or clearing down debt or building your buffer or whatever it is that you wanna do, you’ve got money there without devaluing what you enjoy out of life or without diminishing the value you put on life. I think that’s a really important exercise. Some people would do it, and they say, oh, do I have to do this from now on? Absolutely not. It’s when you feel that wallet leakage is kicking in again, that you need to jump back in again and do it. Maybe the first time you do it, you might do it five or six weeks later, but then you might do it for five or six months because you feel like you’re on top of it. And you do eventually get become a master of it

[00:10:14] Kiersten: Talking money with your partner isn’t always easy, but sharing a AAA membership is an easy win. From roadside assistance to savings on entertainment and dining, travel and insurance, AAA is one of the few things couples always agree on. And if you’re already a member, consider upgrading to add your partner or family members. It’s a small step that can go a long way in your financial life together. Explore benefits at AAA.com/join.

[00:10:40] Julien: You know, we, I believe, call it value-based spending. It’s just this idea. It’s like a supplementary exercise, and I and I completely agree with you there’s something powerful about writing those things down, and then just try to identify some of those patterns and that tends to identify or at least categorize some areas where you think people really should keep it because these are things that obviously are rated very highly by you but it forces people to go through that kind of pruning exercise to say wow I didn’t realize I spent so much money on things that I am also admitting I’m not adding that much value to my life. What’s really interesting is over time, you start to realize that some of the things that you used to rate or rank really highly, you don’t rank them nearly as highly anymore.

[00:11:24] Eoin: Interesting, though, because I do think that’s actually there’s a piece of research out there that describes exactly what you’re talking about. So if you think about it now, and I’m going to put you on the spot, but is there a particular band or a singer or somebody who you think, I just love them right now? Is there anyone you can think of that you just like if they’re coming to town, you’re going.

[00:11:44] Julien: If I’m being honest, no, because that’s another one of those things that has completely fallen off my radar. But 10 years ago, I would have said there was a band called Lake Street Dive that I would have absolutely loved. And I have paid to go see them perform.

[00:11:58] Eoin: It’s actually proven my point even better now. So 10 years ago, if we had to be having a chat, and I said to you, Lake Street Band, is up to say Lake Street, what you call them?

[00:12:06] Julien: Lake Street Dive.

[00:12:07] Eoin: Lake Street Dive, right? I said you, Lake Street Dive are on tonight. I have the last ticket. And you would have said to me, I’ll buy the ticket off you. I’ll give you $100, $200, $300, $500. We roll forward 10 years. Lake Street Dive playing tonight. You want to go maybe nostalgia, but I’m not paying more than $50 for the ticket. And it’s because our values do change over time. And that’s really important to recognize that. But it’s important to be able to really dive into that to make sure that you keep on checking, not only on yourself, but if you’re in a relationship that you’re checking on the other persons as well, so that your values align with each other.

[00:12:40] Julien: If you’re talking about spending conscious and subconscious spending, I found that people tend to disregard the importance of the value or the power of the little things. What do you think people can learn from small or consistent habit building?

[00:12:55] Eoin: I was speaking at a conference, I do a lot of corporate speaking, right, and public engagements and that type of thing. And I was speak at a particular conference and the audience would have been very heavily reliant on what you guys have called social security or certainly on the lower income bracket, and that was the purpose of being there was to try and help these people change their financial future. And somebody came up to me at the end of the conference and kind of approached me as I was coming down off the stage and said, oh, can I just stop you there for a minute? Yeah, of course. And she said I heard you say something about 12 weeks ago on radio, and I started saving for the first time. And I’ve never had savings in my life. She had 60 euros in savings because she had saved 5 euros a week. And I’ll be honest, I don’t want to sound patronizing or anything like it. But I felt more pride in her than my clients who have millions and millions ready to invest because she was proud of herself. The switch that had changed for her was, I had said those couple of weeks before that you’re either a saver or you’re not. And this idea that people say, I’m crap at saving or I’m a terrible saver, I can’t save, that actually isn’t, isn’t true. You are either a saver or you’re not a saver, and whether you accept it or not, you have made a choice between the two. And what I will always say to people is, if you’ve made a choice and you want to switch that and you want to become a saver, you need to pick an amount of money that you say, the next time I get paid, I’m going to save that amount of the money, and I don’t care how small it is, right? I want you to start at that level, but I want it, in fact, to be so small that if you didn’t achieve it, you’d be embarrassed to tell your best mate or your partner you didn’t do it. Because what you do then over time is you turn up the volume on the savings. So you start at one dollar, you start at five dollars, you started ten dollars. The next week or the next month you get paid, you turn it up just a little bit. Turn it up. Now, the whole point of the story is if you’re saying every time I start saving, it fails. I have to dip into it by the end of the month. I never succeed with it. What you need to do is create the habit first. That’s the important thing. Get the habit going that you are now a saver. And then every week or every month or every time you get paid, you just turn up the volume a little more because the other thing you’re doing there is there’s a law called Parkinson’s Law. So Parkinson’s Law is it’s a rule reading. A rule that says a job will take as long as you give it. So if you’ve got to mow the lawn and you have an hour to do it on Saturday before you need to go out for the evening, you’ll get it done in the hour. But if you start at nine that morning and give yourself four hours, it’s gonna take four hours. Okay, just your job expands to the time that you give. And I believe the same happens with our income, OK? So you’re making $100,000 a year. You’re going to spend $100,000 a year. You’re making $200,000 dollars a year, you’re going to spend $200,000 dollars, because lifestyle creep kicks in. Your lifestyle expands to fill the income that you have. And the only way of reversing lifestyle creep or reversing Parkinson’s Law is to turn up the volume on the savings or the intentional stuff that you do on a monthly basis where it’s putting money into your 401(k) or put money savings or whatever else you’re doing.

[00:16:12] Julien: I completely agree with you. One of the questions that I get, and I would imagine you get it as well, is people place this label on themselves and they just say, I’m just, I am bad with money. That’s just who I am. It’s who I will always be. How do you help people kind of change that story that they’re telling themselves about themselves?

[00:16:30] Eoin: First of all, what I would say is, is your money personality, you’re either exactly the same or exactly opposite to the adults you grew up with, whether that’s your parents or somebody else, right? You’re going to be the same, but the opposite, because you’ll be either attracted to what they were like, or you want to be exactly different to them. And that’s embedded very early on. So the first thing to accept is that some of this is inbuilt from an early age, but just because it’s embedded from an earlier age doesn’t mean that you’re stuck with it for life. Whatever way you are right now, you can make that worse or you can make that better. You can make that choice. If you feel that you’re bad with money and you want to be different, you need to treat yourself like a child. And I’m going to get very deep here, but you almost need to speak to your inner child and relearn the stuff that’s ingrained in you so that you can get better at it, and you can be more conscious of us and more aware of us, and you get better outcomes ultimately is what it is. Money can control us or we can control it. And you can do something very simple today that just tips that balance ever so slightly back in your favor. And then it’s about getting little wins on a regular basis to create massive change over long periods of time.

[00:17:41] Julien: You actually don’t realize that you have really deeply ingrained values and beliefs about money and you’re absolutely correct. A lot of it starts with their experiences at home. I think that’s sets the tone for whether or not you believe in ideas like abundance, or if you believe that money is truly something that is scarce. I want to change gears just for a second here. You mentioned lifestyle creep, and I don’t know that everybody understands what that term means. I’m going to ask if you have any kind of tips on things that people can do to reverse or, you know, avoid lifestyle creep or some of this impulsive spending that we know people struggle with.

[00:18:21] Eoin: Yeah, so lifestyle creep in its simplest form is that when you get a pay rise, you feel, and you should feel like you need to reward yourself. So I’m going out for dinner instead of getting the takeaway as a simple example because I’ve just got a pay rise and I deserve it. And you do deserve it, and you do work hard. And if that’s something that you value and it’s really important to you, allow for that one, allow for it somewhere else as well. If you think about it, do you suffer with lifestyle creep is a question you might be asking yourself when you’re sitting at home listening to this and you’re, why suffer with lifestyle creep? Ask yourself, when is the last time you got a pay rise? And there’d be lots of people who would say, I got a pay rise 12 months ago. How does that feel now? And most people will answer, well, it’s made no difference to me whatsoever. And what’s happened there is, is their lifestyle has increased to fill the amount of money that they have, and they just do nicer things with that money. The way to reverse this, and it’s really clear how you reverse this, when you get to a certain salary level, most of the over-excess spending can be cut back without it impacting your lifestyle. And how you cut that back, you can go through it with a fine tooth comb and find out where is your money going. Do you realize you’re spending X amount of money on delivery food and you’re spending this on that and your holidays and your vacations, as you would call it, are being spent on this? If you just say, I get paid X amount per month, and before I do anything, I’m going take a chunk of that, and I’m going to put it into savings or I’m going to put it into my 401(k) or going to do something with it, I’m gonna take it out of my checking account because once I do that, and I have everything else covered, it’s only the stuff that’s left over in your checking account that you end up spending, and you will then end up being suffering with Parkinson’s Law or Lifestyle Creep. I think that’s really important that if you realize that if you do it immediately and you automate it and you take the money at the start, Lifestyle Creep doesn’t have anywhere to expand into.

[00:20:19] Julien: What kind of emotional roadblocks do you see most people have?

[00:20:23] Eoin: When it comes to money and what keeps people awake at night is uncertainty. It’s around what is next, what happens if inflation doesn’t get under control. It’s a huge problem throughout the world, but it’s the not knowing what’s next, and it’s not understanding how can I prepare today for the unknown future. And it can, it can really send you around in spins and circles. And like, even if you think about it in simple terms, if you’ve got cash and you’re sitting and you have it in your checking account or in your savings account, and I say to a client, everything called the five-year-rule. If you don’t need your money in the next five years, get it out of your checking account and get it into an investment account and whatever you’re doing, just get it somewhere where it’s working hard for you. And then people say, Oh, but what if I need it? What if I need? Well, have you needed it in the last 10 years? No, I haven’t. But what if I do in the next five? I can’t afford to put it away. I can afford to ride out the storms. And it’s the stuff they don’t know, they don’t know which is scaring them the most. There is people out there that are means that will say, I’m worrying doesn’t do anything. It doesn’t make the problems go away. But we do spend a huge amount of time worried about stuff that’s never going to happen. Now, this is a joke. And I just hope I translate probably said and 95 percent of the things I worry about never happen. You see, worrying works. The reality is, most of the stuff we worry about doesn’t happen. There’s so much stuff that consumes us and what I would say rents space in our head that we need to get out of there and it is a blockage when it comes to taking action, whether that action is financial or that action is some other part of your life.

[00:22:05] Julien: I want to close and maybe see if we can do a little bit of myth busting here. Is there a particular belief or a myth about money that you wish more people would just let go of?

[00:22:15] Eoin: Financial future is not predetermined. Now, more than ever, I strongly believe you can create your financial path, financial future, whatever way you want it to be. It’s interesting you talk about the difference between positive thinking and negative thinking, right? And if I say to you, if you think negative, negative things are going to happen. Most people will accept that outright. They would say, oh, yeah, no, I get that. But if I said to somebody, if you think positively, positive things are going to happen. Lots of people will challenge that, say no, they won’t, you can’t imagine a good future and you’re going to get it. But you’ll accept it on the opposite side, negative makes negative, but you won’t accept they’re equal and opposites. So therefore you believe in one, you have to believe in the other. What I love about money is it’s black and white. And what I mean by that is there’s a right answer and there’s wrong answer. But it’s also relative, it’s percentage based. Right, so we had somebody who won a lot of a lottery here last last week, won 250 million euros and a lot of a quarter of a billion, here it’s tax free by the way, right. They won a quarter of a billion, biggest win ever. And the investment advice that person should be getting with 250 million is the same investment advice you should be getting with your 250 dollars because math makes it equal. And that’s one of the myths we need to get over that, oh, it’s only good for the rich or it’s no good for me because I’m not at that level. It’s math and it’s agnostic to what the number actually is because it’s percentage based, and it is either black or white, it is right or it is wrong. That’s it.

[00:23:53] Julien: I really enjoyed this conversation with Eoin, and I especially loved that he shared some deeply personal aspects of his life.

[00:24:00] Kiersten: I really enjoyed that you shared some things as well. You talked about how you used to prioritize concert tickets and now those things aren’t as important to you. And it made me think, do I have anything in my life that way? And it’s actually the opposite. There are things that I didn’t use to prioritize that I do now, like sleep. Like I will spend more money to ensure that I get a good night’s sleep. I have a sturdy sleep routine at home. Any sort of product or pillowcase or sheet set, a cooling fan, all of that stuff is going to hit the cart versus in the past like when I was in my 20s I could sleep on a hay, like a pile of hay. It did not matter where I slept. I could sleep sitting up and now I actually, I need that comfort.

[00:24:45] Julien: Yeah, and it just goes to show, just as Eoin outlined in our conversation, as you change, your values change and those things affect the way that you spend your money. There’s nothing wrong with that, but it is important to pay attention to that and making sure that you are adjusting along the way. Thanks for listening to Merging Into Life, brought to you by AAA Northeast. If you found this helpful, share it with a friend and subscribe wherever you get your podcasts.

[00:25:13] Kiersten: The views and opinions expressed in this podcast do not constitute financial advice and are not necessarily the views of AAA Northeast, AAA, and or its affiliates.

Merging Into Life: Budgeting 101

Smart Personal Savings and Budgeting Apps

10 Money Saving Habits to Start Right Now

Julien & Kiersten Saunders: rich & REGULAR

"*" indicates required fields

*The views and opinions expressed in this podcast are not necessarily the views of AAA Northeast, AAA and/or its affiliates.

AAA Northeast joined forces with 19 other clubs to fill food pantries, kitchens and plates through this year’s AAA Road to Hunger Relief campaign.

Throughout June, food donation boxes were placed in all 65 branches across the AAA Northeast territory and administrative offices. Employees also volunteered shoulder to shoulder with members at various events, including collecting donations curbside at grocery stores, preparing food for those in need and stocking shelves at pantries.

Donations were distributed through Feeding America, a nationwide network of food banks.

The first coordinated national charitable campaign in AAA’s modern history, the AAA Road to Hunger Relief set an ambitious goal: to provide at least 3.5 million meals to families in need across the country.

More than 14 million children in the U.S. don’t have enough food to eat or don’t have access to healthy food, and more than 47 million people face hunger across every U.S. community, according to Feeding America.

Food insecurity is especially prevalent in the summer when children don’t have access to free school meals and donations to food banks decrease.

“The goal is to impact as many people as we can,” said co-leader of the AAA Northeast Member Engagement team and district branch manager Tom Ryan. “To increase the number of families served, the number of pounds of food collected, delivered and prepared. That’s how we measure success.”

Featured image: Member services counselor Tawana Hargis fills boxes at the Rhode Island Community Food Bank.

Flying Business and First Class may still be the dream for many travelers, but now there are options for passengers seeking a step up from economy class at a more affordable price point. A number of airlines have created front-of-the-plane seat categories that offer a few premium perks to make your travel more comfortable. Here are a few options available for those who want to enhance their flight experience.

Condor’s Premium Economy Class, available on long-haul flights, offers you a seat pitch (the distance between your seat and the seat in front of you) of 35 inches, a seat width of 18 inches and a recline of up to 6 inches. In Economy Class, the seat width is the same, but the seat pitch is only 30 inches and the recline is up to four inches. You also get a multi-adjustable headrest and footrest, a travel kit and headset, a classic premium menu and a large choice of both nonalcoholic and alcoholic beverages.

Delta is refreshing the interiors of all its aircraft over the next couple of years. You’ll see a modern new design, fresh seating materials and enhanced lighting.

Seats in Delta Comfort+ provide extra legroom with an average pitch of 34 inches compared to an average 31 inches in the main cabin, plus earlier boarding and deplaning and dedicated overhead bin space. During domestic flights in Delta Comfort+, you get a choice of premium snacks on many routes over 900 miles when meal service is not available. On long-haul international flights, you receive an amenity kit. Both main and Comfort+ offer a pillow, blanket, as well as complimentary beer, wine and spirits on long-haul flights.

When flying Delta Premium Select, the seat pitch averages about 38 inches with a wider 19-inch seat compared to 17.2 inches in Delta Comfort+ and main. Plus, there is an additional recline at 7 inches and an adjustable footrest and leg rest on most long-haul international flights. In Delta Premium Select, you receive expedited check-in, security and baggage service, and are among the first to board. This dedicated cabin also offers hot towel service and a beverage and a snack before your meal. An exclusively designed menu includes the ability to preorder your meal up to 24 hours before the flight. You also get a premium amenity kit, memory-foam pillow, a plush blanket, a larger entertainment screen and noise-canceling headphones.

The new Lufthansa Allegris travel experience on long-haul flights launched in May 2024 with a large part of the fleet expected to be outfitted with Allegris by the end of 2025.

Depending on the aircraft, the new Allegris Premium Economy seats have a pitch of 39 inches, width of 19 to 19.5 inches and 7-inch recline compared to Economy Class, which has 31-inch pitch, 17- to 18-inch width and 5-inch recline. Its hard-shell design features adjustable headrest, armrest and footrests.

These newly designed aircraft feature larger entertainment monitors for the upgraded cabin. Higher-quality noise-canceling headphones are provided for better audio. The dining experience is also an upgrade with a higher-quality meal typically served on fine China tableware and with a choice of two hot main courses, plus a welcome drink upon boarding and a bottle of water at your seat. A travel kit and cocktail table at the armrest add to the in-flight experience.

You’ll also be able to bring more with you with double the allowance than standard Economy with two checked bags, each up to 50 pounds. Select airports may also have a dedicated Premium Economy desk for faster check-in times.

Wider seats and more legroom are among the pluses of Singapore Airlines’ Premium Economy cabin. The seat pitch is 38 inches, the width is 19.5 inches and the recline is 8 inches with a calf rest and footrest. (Economy class offers a seat pitch of 32 inches, a seat width of 18.5 inches and a recline of 6 inches.)

You’ll get priority check-in, priority boarding and priority luggage handling. You can preorder gourmet meals through the Book the Cook service, which allows you to select from a variety of premium meal options before your flight. Complimentary beverages include alcoholic beverages, Champagne and wines.

In-flight entertainment screens are typically larger, and you’ll get high-quality noise-canceling headphones. The amenity kit for Premium Economy features an eye mask, slippers and lip balm (available upon request). You’ll even get larger, more comfortable pillows and blankets than in standard Economy and a dedicated storage space for personal items.

Select long-haul international flights and some premium transcontinental routes feature United Premium Plus seats. These larger seats offer a 38-inch seat pitch, a width ranging from 18.5 to 19 inches, 6-inch seat recline and a leg rest. You get an enhanced meal service, including upgraded dinnerware with complimentary wine, beer and spirits. Noise-reducing headphones and an amenity kit, blanket and pillow, and larger in-flight entertainment screens are also part of the in-flight extras. At the airport, you’ll benefit from priority check-in, exclusive security lanes, priority boarding and two free checked bags with priority bag handling.

United also offers United Economy Plus on all United flights and most United Express flights. It is located near the front of the Economy cabin and features extra legroom compared to Economy. It has a seat pitch that ranges from 33 to 37 inches, seat width that ranges from 16.3 to 18.5 inches and 3-to-4-inch recline. Economy has a seat pitch that ranges 30 to 32 inches, seat width from 16.3 to 18.5 inches, and 2-to-3-inch recline. Meals and in-flight service are the same as Economy.

You don’t have to fly first class to elevate your flying experience. Get more for your money with one of these more attainable upgrade options.

Book your next flight with a AAA travel advisor. AAA travel services are just one of the free perks of your membership!

Featured image: United Airlines Economy Plus. Photo courtesy of United Airlines.

Through the muddy thunderstorms of summer and salty roads of winter, the elements take their toll on your car’s exterior, sometimes requiring more than a simple wash to keep it looking its best. A proper waxing helps bring your paint job back to life and prevents further damage. We turned to our pros — AAA Northeast Car Doctor John Paul and Jason Carrara, senior manager of automotive services training — for their top car waxing tips to get your car looking like new again.

Waxing your car consists of two components: applying the wax and buffing. Simply put, waxing rejuvenates the paint and polish gives it a shine. Waxing helps maintain the car’s finish, which also means maintaining its value. A waxed car is a protected car. A good coat of wax forms a protective coat over the paint, which will help repel road grime, bird droppings and tree sap. Although if your car gets hit with any of these (or other debris), you should wash it off immediately. The acids can cause permanent damage to the paint.

Before you can begin waxing your car, it must be clean. Dirt and grime can mar the finish. To properly wash it, use the two-bucket method, with soap and clean water in one bucket and rinse water in the other. Using one bucket dirties the clean soap water and the grime you just removed from your car goes right back onto the car’s surface. In addition, make sure to only use car wash soap. Dish detergent will strip any wax off your car.

Before waxing, your car should be completely dry. Water droplets will cause the product to streak. You should also wax your car in the shade or indoors, if possible. This will prevent the car’s surface from becoming too hot and drying out the wax. If the wax dries too quickly, it will be difficult to buff off.

Some drivers, especially those with vehicles that have darker color paint, will use a dedicated polish before waxing. Polish before wax will produce a deeper shine.

There are two main types of wax: synthetic and carnauba. Carnauba is a natural wax that produces a deep shine but may not last as long as a synthetic wax. There are also spray-on waxes that are great for a quick touch-up after washing.

The latest product on the market is ceramic coating. This coating provides great protection, but is expensive and generally only applied by a professional detailer.

Once your car is clean and dry, it’s time to evaluate the surface before applying wax. Light paint swirls can be cleaned up with polishing compound. Deeper imperfections may require a more aggressive cleaner/polish. A clay bar can be used with a dedicated lubricant to remove very minor imperfections in the paint.

Spread a small amount of wax onto your cloth or pad. Then apply it to the car using a circular motion and steady pressure. Keep working the wax into the paint until it’s completely absorbed. It’s best to focus on one small section of the car at a time until you’ve covered the entire automobile. Avoid getting wax on any non-painted plastic moldings or trim around the vehicle. This can discolor the plastic and can be difficult to remove once dried.

One of the wisest car waxing tips to remember is to apply as thin a layer of wax as possible. It may be tempting to apply a thicker coat in order to get more shine and depth, but the excess wax will be difficult to remove and become streaky. Instead, if you desire more shine, complete one application, buff that coat off, and apply another very thin coat. Check the instructions on the product’s label to know how long one application of wax needs to fully cure. Usually it’s about 12-18 hours.

Once the wax is applied, it needs to be buffed. This step ensures that the wax fully bonds with the paint. Using a clean towel or microfiber cloth, gently rub the paint until you get the shine you’re looking for. The best results tend to come from using a microfiber towel. The static-charged, woven fibers grab the wax residue and polish the paint while you buff. In addition, microfiber does not shed lint. Make sure to rotate your towels frequently so that you’re always working with a clean side. Always follow the manufacturer’s directions.

As a general rule, a coat of wax lasts three to six months. Depending on how often you do it, waxing can be a labor of love. However, the benefit of waxing a car is that it will keep your automobile looking great and extend the life of the paint job, thus increasing the car’s value.

Get car waxing tools at NAPA Auto Parts, where AAA members receive a discount.

Is a well-polished car important to you? Share your car waxing tips in the comments.

California’s Napa Valley offers a combination of activities, attractions and scenic beauty. A recent trip to the towns of Napa and Calistoga with my husband and our two daughters proved that these elements make the area an ideal vacation spot for families traveling with adult children.

Napa Valley is made up of five towns that include Napa and Calistoga, as well as Yountville, St. Helena and American Canyon. Some 58 miles north of San Francisco International Airport, it is home to more than 400 wineries and over 90 tasting rooms.

Nicholas Bunnell, Travel Sales Manager for AAA Northeast, has visited the area twice.

“These trips allowed me to explore the rich wine heritage, offering a blend of wine tasting experiences and gourmet dining,” he said.

Visit Napa Valley, the local tourism board, has an excellent online tool for finding the perfect winery for tours and tastings based on your favorite wine, budget and desired amenities.

The iconic wineries that dot the region were just the beginning of our “family time” activities during our trip to Napa Valley.

We enjoyed “The Evolution of Elusa” 90-minute tour and tasting at Elusa Winery in Calistoga, which is on-site at the AAA Four Diamond designated Four Seasons Resort and Residences Napa Valley. The maximum tour size is six people, so we were lucky enough to have a private experience with just the four of us. The tour included a golf cart-led drive of the vineyards and a walk through the winemaking and storage facilities. Our time at Elusa ended in the beautiful Tasting Salon, where we sampled vintages accompanied by cheese and other snacks and an informative and passionate take on Elusa’s process.

The historic Napa Valley Wine Train is another way to explore the area’s wineries, this time traveling in one of its restored 1915 Pullman cars. The six-hour Legacy Experience includes a welcome glass of sparkling wine, a four-course onboard meal, tasting in an open-air car and seated tastings at two wineries in St. Helena.

he Napa Valley Wine Train as a must-do unique dining experience, Bunnell said.

“Having some incredible food and local wines while admiring the beauty of Napa was unforgettable,” he said.

Along with wineries, Napa Valley boasts more than 150 restaurants — 15 of which are Michelin rated, seven total stars. We found the quaint towns of Napa and Calistoga lined with some of these restaurants as well as charming boutique shops. One top dining pick for my family was Scala Osteria in Napa, a beautiful restaurant with high-level service and a Southern Italian menu focused on seafood.

For another walking trail option, the Petrified Forest, a California Historical Landmark in Calistoga, offers guided and self-guided tours of its trails, which are lined with petrified redwood trees that date back 3.4 million years and were first discovered in 1870. The two half-mile trails also feature California native plants and a view of Mount Saint Helena. Dave, our knowledgeable naturalist the day we visited, has been giving tours of the family-owned-and-operated Petrified Forest for more than 30 years.

We couldn’t miss the opportunity for some spa time, especially in Calistoga, known for its mineral-rich mud. Four Season’s Spa Talisa’s Spa Garden is a great way to try out self-applied mud together as a family while relaxing on the sunning bench.

In Napa, plan for some pampering at the Spa at Silverado Resort. We opted for massages and enjoyed post-treatment time lounging at the spa pool and eating snacks from the Boost Cafe.

Besides top dining, two PGA golf courses and a full-service spa, the AAA Four Diamond designated Silverado Resort offers complementary fitness classes, tennis, pickleball and bocce, as well as three outdoor swimming pools. It is also only a short drive to downtown Napa and is close to many area wineries.

A California landmark for more than 150 years, Silverado’s signature white mansion was built in 1870. Today, it includes the reception and bar. The resort’s 117 guest rooms and 228 suites are spread out on 300 acres. Its two- and three-bedroom suites are ideal for families of every age with amenities such as full kitchens, living rooms, dining areas and private patios or balconies.

Plan your Napa Valley trip with a knowledgeable AAA travel advisor. AAA travel services are just one of the free perks of your membership!

Featured image: Courtesy of Visit Napa Valley. Photo credit: Michael Cuff.

Even as gasoline inventories fell by a substantial 3.3 million barrels in the Northeast last week, according to the Energy Information Administration (EIA), stocks still sit squarely above levels seen in the past two years and are just shy of the five-year average. The significant drop last week was due in large part to a brief shutdown of refinery operations at Phillips 66’s Bayway refinery in Linden, New Jersey, after severe thunderstorms knocked out power and caused flooding issues. The refinery is a critical source of gasoline for the region.

Demand for gasoline, meanwhile, climbed last week to 8.967 million barrels a day — an increase of nearly 500,000 barrels a day from the previous week, according to the EIA. The figure is more in line with expectations for this phase of the summer driving season but is not high enough to raise concerns about impact on supply.

Another factor weighing down pump prices is the cost of crude oil, which settled at a three-week low Friday as markets remain unsure about the strength of the global economy.

“Typically, a refinery outage like the recent incident at the Bayway refinery in New Jersey could cause price spikes at the pump,” said Jillian Young, director of public relations for AAA Northeast. “Thanks to the region’s healthy gasoline inventories, the potential price increases did not materialize, and drivers are still enjoying seasonably low prices compared to last year.”

AAA Northeast’s July 28 survey of fuel prices found the national average unchanged from last week ($3.14), averaging $3.14 per gallon. The national average price was 5 cents lower than a month ago ($3.19) and 46 cents lower than this day last year ($3.50).

| Region | Current Price* | One Week Ago | One Month Ago | One Year Ago |

| Connecticut | $3.11 | $3.12 | $3.18 | $3.55 |

| Massachusetts | $3.04 | $3.05 | $3.08 | $3.47 |

| New Jersey | $3.02 | $3.05 | $3.18 | $3.39 |

| New York | $3.16 | $3.17 | $3.21 | $3.60 |

| Rhode Island | $3.01 | $3.03 | $3.06 | $3.42 |

*Prices as of July 28, 2025

As of July 28, Mississippi and Oklahoma had the lowest prices in the nation at $2.70 and $2.72, respectively. Hawaii and California held the highest prices in the nation at $4.48 and $4.47, respectively.

The AAA Gas Prices website is your resource for up-to-date fuel price information. Search for average gas prices on national, state and metro levels by regular, plus, premium and diesel.

As the heat turns up, so does the risk of heatstroke.

Warmer than usual temperatures are to be expected in the Northeast during the summer months, although as a result of climate change, the frequency, duration and intensity of heat waves that we experience every year is only projected to increase, according to the World Health Organization.

When the mercury starts to rise into the 90s and push up into the 100s, it can become dangerous to our health, homes, cars and pets. However, it’s important to start thinking about hot car and extreme heat safety, even if there isn’t a heat wave in the forecast, as even a mild, sunny day, can make the inside of a car lethally hot. Here’s how you can guard against the risks.

Soaring temperatures cause your body to strain to maintain normal conditions, which can quickly lead to organ failure and even death in some cases. Excessive heat is the leading weather-related killer in the United States, according to the National Weather Service.

It is often a combination of high heat and humidity that can lead to illnesses like heat cramps, heat exhaustion and heatstroke. Learn the warning signs of each, and if you experience the symptoms or notice them happening to someone else, act right away. Most importantly, stay cool and stay hydrated.

Populations most prone to heat-induced sickness include the elderly, overweight individuals, infants, children and pregnant women. Outdoor and manual workers are also at higher risk. If you are a business owner with employees that often works in these conditions, such as a contractor, you want to make sure you have the right insurance coverage in place.

Pets, particularly dogs and cats with thick coats and short snouts, can quickly fall victim to heatstroke, as well. Signs include panting or difficulty breathing, drooling, weakness, increased heart rate, lethargy and collapsing. Make sure your pets stay cool and well hydrated, don’t over-exercise them when it’s hot and keep them out of the direct sun.

Heatstroke is the most common non-crash, vehicle-related cause of death in children under the age of 15. Over 20% of deaths result when a caregiver knowingly leaves a child in a car, typically to run a quick errand or let the child finish a nap, according to NoHeatStroke.org.

On a typical 80-degree summer day, the interior temperature of a vehicle increases by 20 degrees in only 10 minutes and reaches a deadly 109 degrees in 20 minutes. On hotter days, the interior temperature can easily reach 120-140 degrees, and cracking the windows has little effect.

And it doesn’t have to be scorching hot outside to get dangerously hot inside a car. Although most hot car deaths occur when temperatures are over 80 degrees, a child has succumbed to vehicular heatstroke in 70-80-degree weather in each of the past ten years.

To prevent hot car deaths, AAA Northeast recommends caregivers practice the following:

Statistics about pets dying in hot cars are not tracked as closely, but the American Veterinary Medical Association reports that every year, hundreds of pets die of heatstroke in parked vehicles. In most Northeast states, it is illegal to leave a pet unattended in a parked car.

If you see a child or animal confined in a hot car, act fast and do whatever is necessary to get them to safety as quickly as possible. Immediately notify a nearby business so they can make an announcement to find the potential caregiver, call 911 and wait until help arrives.

AAA stays busy in the summertime, as breakdowns tend to spike on hot days.

Extreme heat can take a toll on cars and can be especially stressful on engines. Check the coolant and make sure that it is periodically flushed and replaced as recommended by the vehicle manufacturer to prevent long-term engine damage and overheating.

Car batteries also hate the heat. Battery fluid evaporates faster in the summer, leading to corrosion. If a car’s battery is more than three years old, it’s a good idea to have it tested by a trained technician. AAA members can request Mobile Battery Service or take their car to any AAA Approved Auto Repair facility to be tested. And while you’re there, have them make sure your tires are inflated to the manufacturer’s specification and the AC is operating at full capacity.

If all precautions fail, you know who to call.

Check out more summer driving safety tips from AAA.

When it gets to be too hot outside, you want your home to be a place of refuge where you can cool down. To keep the hot air out, Ready.gov recommends weather-stripping windows and doors, installing window air conditioners with insulation, covering windows with drapes or shades, using attic fans and setting up window reflectors such as aluminum foil-covered cardboard to deflect heat outside.

Preparing your home for extreme heat should be part of seasonal maintenance. Aside from making sure your house is as cool and energy-efficient as possible, without proper upkeep, heat can eventually start to take its toll on the structure. In the Northeast, this might include roof damage. Over time, roofing can expand and contract during extreme hikes and dips in temperature, making it susceptible to splits and leaks.

How do you stay cool in extreme heat? Tell us in the comments.

Protect you car, home, small business, pets and more with AAA Insurance.

This article has been updated and republished from a previous version.

Many people love the whole beach experience — the sea, the sun and even the sand. But let’s be honest: The sand would be a lot more lovable if it stayed at the beach.

Spending hours vacuuming stubborn grains of sand from seats, carpets and all the crevices of your car can take some of the shine off a sunny day.

The good news is, you don’t have to choose between an fun beach day and a clean vehicle. Here are some tips to keep the sand at bay and make cleanup easier.

So, don’t fear the sand. The beach awaits.

After four years of surging vehicle thefts, the number of stolen vehicles in the United States fell to pre-pandemic levels in 2024, according to the National Insurance Crime Bureau (NICB). There were 850,708 vehicles stolen nationwide last year, a 17% decrease from the historic peak of 1,020,729 thefts in 2023 — marking the largest annual decrease in stolen vehicles in the last 40 years.

Despite the decrease, approximately one vehicle is still stolen every 37 seconds in the U.S. according to the National Highway Traffic Safety Administration, costing vehicle owners billions of dollars each year.

“Vehicle thefts and break-ins have been far too common in recent years, and typically spike in the summer,” said Lauren Fabrizi, spokesperson for AAA Northeast. “But by putting the proper protections in place, thieves are less likely to take off with your car or valuable items inside.”

AAA Northeast recommends the following to prevent vehicle thefts:

Immediately reporting a stolen vehicle in the first 24 hours increases your chance of recovery by 34%, according to the NICB. Once you’ve filed a police report, notify your insurance company about the theft. Have information ready including your vehicle’s make and model, license plate number and vehicle identification number (VIN).

In Connecticut, there were 8,725 reported motor vehicle thefts in 2024, according to Connecticut State Police. The latest FBI data shows that nearly 40% of vehicle thefts in Connecticut took place from May to August.

In New York, there were 31,865 reported motor vehicle thefts in 2024, according to the New York State Division of Criminal Justice Services. The latest FBI data shows that nearly 39% of vehicle thefts in New York took place from May to August.

In New Jersey, there were 16,970 reported motor vehicle thefts in 2023, according to the latest FBI data. Roughly 38% of those thefts took place from May to August.

In Massachusetts, there were 7,540 reported motor vehicle thefts in 2024, according to the Massachusetts Executive Office of Public Safety and Security. The latest FBI data shows that over 38% of vehicle thefts in Massachusetts took place from May to August.

In Rhode Island, there were 1,368 reported motor vehicle thefts in 2024, according to Rhode Island State Police. The latest FBI data shows that over 35% of vehicle thefts in Rhode Island took place from June to September.

As a farmers market frequenter, I’ve always loved strolling past each tent’s unique offerings and stocking up on fresh fruits and veggies for the week. But it never occurred to me that instead of going to the farmers market, that the farmers market could come to me. That is, until I learned about CSAs.

Community Supported Agriculture (CSA) is a program that’s predicated on the idea that farms and their community members share a mutual interest: supporting each other.

When you join a CSA, you are essentially purchasing a share of a farm’s output for a range of time (typically the growing season, summer through fall). Each week your share is made available for pick up or delivery, depending on the farm, and consists of that week’s bounty — from vegetables and fruit to eggs, mushrooms, bread, flowers, jam and more.

For both farmers and CSA members, the benefits are plentiful. Farmers receive payments early in the growing season, shoring up funds to maintain the growing season without financial worry, and members get to delight in locally grown goodness. Joining a CSA is also a great way to become more sustainable as it encourages local dollars to stay local while helping to eliminate unnecessary food waste. A farm’s surplus that may have been wasted otherwise is instead redirected toward CSA members, helping to nourish the community.

To find a CSA near you, search your zip code on Local Harvest. Each listing gives a summary of the farm, share prices, contact information and more so you can decide which one is the best fit. CSA sign-ups typically begin prior to the season, around March, and can fill up fast so it’s helpful to be ready with your choice ahead of time.

Every CSA is different and cost will vary just as much. Some CSAs offer types of shares, like half shares versus family shares, to give options when it comes to pricing and the amount of food you receive. If a share price seems high, remember that there are many variables to take into account, like whether the farm delivers your share to your door, how many weeks are included or if there are any available add-ons to supplement your share. There are many CSAs to choose from, so take the time to find a program that fits into your schedule, budget and lifestyle.

Besides looking forward to what fun, new vegetable will be in our share each week, being part of a CSA has instilled a deeper sense of connection to the food that I eat. Knowing where it came from, how it’s grown and meeting the people who grow it has had a profound influence on how I consume, including how to be more intentional and less wasteful.

I’ve also cut down on grocery store visits. With a variety of produce coming my way each week, I’m only heading to the store for essentials, if at all. Eating with the seasons, supporting local farms and saving money? Win, win.

Sometimes you’ll receive something in a CSA box that you’re not sure what to do with (see: garlic scapes), or maybe you’ve gotten an ingredient a few times now and can’t think of another way to make use of it (ahem, zucchini). Some CSAs get ahead of this by providing recipe inspiration with each week’s box and encouraging members to share any recipes they loved. This way, nothing goes to waste and you try something new.

As you might’ve guessed, we recently received a bunch of zucchini with our CSA share and didn’t know what to do with it. Enter, chocolate zucchini bread.

Watch how it all comes together with other ingredients we got from our CSA below:

Check out Local Harvest to see the CSAs available in your area.

Looking to switch up your summer plans with your four-legged companion? The Northeast offers a variety of unique, pet-friendly activities beyond the usual dog beach and hiking trails. From harbor cruises and pool parties to cafe hopping and baseball games, there are countless ways to bond with your pet while exploring the region.

And if you’re searching for a place to stay or grab a bite, don’t miss our list of 20 pet-friendly hotels and restaurants in the Northeast — perfect for your summer getaway and beyond.

Cool off this summer with a private pool rental through Swimply, where many pool owners allow dogs to join in the fun. In New Jersey (and throughout the Northeast) there are dozens of dog-friendly pools available this summer. You’ll find pools equipped with dog toys, floats and even lazy rivers, beating out the standard dog park pool.

Boris & Horton, New York City’s first dog-friendly cafe, is a paradise for pups and their people. Dogs can roam leash-free in designated areas while their humans sip coffee and snack on baked goods. You’ll find plenty of treats for your pup, plus a curated shop full of dog toys, outfits and accessories. Don’t miss their Yappy Hours and adoption events.

Take in the sights of Boston from the water alongside dozens of wagging tails on the Massachusetts Bay Lines Dog Days of Summer Cruise. This 90-minute scenic cruise departs from Rowes Wharf and sails past the Seaport District, federal courthouse, and other landmarks. Dogs ride for free and are treated to water and snacks, while humans can purchase refreshments onboard.

No boat? No problem. Use GetMyBoat, a platform for pair-to-pair boat rentals and charters, to rent a dog-friendly vessel complete with a captain. In Stamford, Connecticut, and other Northeast locations, you can customize your adventure — try paddleboarding, fishing or stopping by a dog-friendly beach for a photo op. Other top picks include a pet-friendly cruise past the Statue of Liberty (fishing optional!) or a private charter out of Newport, Rhode Island.

Experience mountain magic with your dog on a gondola ride to the summit of Mount Mansfield at Stowe Mountain Resort. The ride offers panoramic views of Vermont’s summer and fall landscapes, and once you reach the top, you’ll have access to scenic hiking trails that welcome leashed pets. It’s sure to be a tail-wagging good time!

If you and your pup love the great outdoors, consider a stay at Huttopia White Mountains. This pet-friendly campground offers cozy wood and canvas tents, scenic hiking trails and swimming holes within the White Mountain National Forest. It’s the perfect basecamp for exploring nature, without leaving your furry friend behind.

Finding pet-friendly water adventures can be a challenge, but not in Portland. Climb aboard with Portland Schooner Co. for a relaxing sail through Casco Bay, where you and your pup can enjoy views of lighthouses, the rocky coastline and maybe even seals if you’re lucky. Pets must be comfortable on boats and able to sit calmly in your lap. Bring snacks, pack your favorite drink (it’s BYOB!), and enjoy the sea breeze with your best friend.

Take your pup out to the ballgame with the Brooklyn Cyclones at Maimonides Park. Their Bark in the Park events welcome dogs into designated seating areas and include special perks, like a chew toy or pup cup. Be sure to arrive early for the pregame pup parade!

Explore the 13-mile bike trail at Presque Isle State Park with your pet riding comfortably in a dog trailer, available through Yellow Bike Rental Company. Choose from bikes, trikes or tandems while your pup enjoys the breeze and scenic views. Stop at one of the dog-friendly beaches along the way to let your fur-baby stretch its legs.

Cuddle up under the stars at Rustic Tri-View Drive In in North Smithfield, one of Rhode Island’s favorite seasonal attractions. Pets are welcome, and there are designated walking areas to stretch your pup’s legs before showtime. Don’t forget to bring a blanket and your dog’s favorite snacks while you hit the concession stand for your own movie treats.