Related Articles

Trending Articles

NEWEST ARTICLES

Subscribe to Your AAA Newsletter

Sign up and receive updates for all of the latest articles on automotive, travel, money, lifestyle and so much more!

The first children’s museum opened its doors in Brooklyn in 1899. Since then, children’s museums have steadily grown in sophistication. These museums help children engage in learning through play. They also offer ongoing classes and provide venues for family entertainment, making them important community centers.

We’ve rounded up 12 of the best children’s museums in the northeast, each with its own unique vibe and offerings. While we list admission price ranges, please note that these museums have membership programs which may prove more affordable than single tickets for repeat visits. Most of these museums also provide free or reduced-cost day passes through their local libraries. These passes often are booked well in advance, though, so plan ahead.

Need a ride? Rent a car.

Newtown

Admission: $3-$10

This museum focuses on (science, technology, engineering, and mathematics (STEM) learning through play. The hands-on displays on wind, water, gravity and motion might appeal most to children 5 and under. Unlike many other children’s museums, the layout of EverWonder is divided into smaller rooms, which may be especially appealing to those prone to sensory overload.

Bridgeport

Admission: $15-$18

This newly renovated and expanded museum offers a cutting-edge STEM play experience, with permanent exhibits dedicated to the exploration of space science and physics, as well as an awe-inspiring planetarium. For children not obsessed with outer space, there are more generalized play areas, including a hospital for teddy bears.

Norwalk

Admission: $16-$20

This hands-on science and natural history museum features exhibits geared toward older children who like to learn through play. Highlights include a multimedia television production experience that puts kids in front of and behind the camera, a paleontology dig site for dinosaurs and a lab to explore the energy-generating capacity of moving water.

Boston

Admission: $22

The Boston Children’s Museum offers something for kids of all ages. Highlights of the three-floor landmark include a large room dedicated to water play, an enclosed climbing maze and animatronic dinosaur displays. In good weather, check out the nearby playgrounds by the Charles River.

Worcester

Admission: $14-$19

Visiting EcoTarium is like being at several museums at once. The large children’s museum includes hands-on displays to learn about natural history and science, enclosures to observe otters, owls and a mountain lion and a preschool room – a “mini-Worcester” where little ones crawl, climb and play. In good weather, the museum also offers a large outdoor play area and an open-air train ride to survey the extensive grounds.

Wenham

Admission: $8-$10

This cozy play-based museum offers many opportunities for open-ended, tactile play and to learn about New England history. Highlights include a panoramic model-train landscape, as well as a preserved 17th century living room. This hands-on museum is best suited for energetic toddlers and young children.

Florham Park

Admission: $7-$22

This children’s museum provides plenty of opportunities for freeform, imaginative play. Highlights include a supermarket display, a climbable pirate ship and a full-size cab of a fire truck within a kid-sized firehouse. Little ones will find plenty of possibilities for play here.

Jersey City

Admission: $26-$31

“Epic” may best describe this 300,000-square foot museum, which houses the Western Hemisphere’s biggest planetarium and a skeletal display of a blue whale. Other highlights include an 80-foot touch tunnel to navigate in pitch darkness, and a vast, suspended climbing place space. Liberty Science Center has exhibits catered to kids of all ages, from toddlers to teens.

Garden City

Admission: $16-$18

This intimate children’s museum is dedicated to play for younger children, with revolving and permanent exhibitions, live theater and art spaces. The museum’s exhibits are colorful and well-designed to invite sensory exploration, and there are opportunities for outdoor fun in good weather.

Poughkeepsie

Admission: $14.50

Located in a bright-yellow building overlooking the Hudson River, this cheery museum is structured to encourage open-ended exploration through play. The hands-on displays are designed to capture the imagination and spark the creativity of small children, although older children may begrudgingly have fun, too.

Rye

Admission: $12-$18

A perfect rainy-day activity located just steps from the beach, this museum provides opportunities to play and learn for younger children. Highlights include the 48-foot-long Pixel Wall, with pegs for making a constantly changing mural of colorful artwork and a larger-than-life Erector-like set, for older children who are into building and design.

Providence

Admission: $16

This smaller museum is perfect for entertaining little ones for a morning or afternoon, with indoor and outdoor play structures and opportunities for hands-on learning. Highlights include a water play room and a room for creating magnetic mazes and shaping tubed structures that utilize wind power.

Save on museums and more with AAA Tickets.

Featured image: Courtesy of Stepping Stones Museum for Children

SEASON 1: EPISODE 10

Episode Feedback

Getting the garbage out on time for pickup, staying on top of the dishes, exercising regularly … these are all small but mighty everyday accomplishments. However, few small tasks are as satisfying or as impactful as creating a budget that actually works.

So, what is the easiest way to start a budget?

In this episode, Ashley Bove, workplace financial consultant with Fidelity Investments, shares simple and straightforward budgeting 101 pointers for beginners. Listen for tips on how to allocate for living expenses, save, build an emergency fund, repay debt and stop living paycheck to paycheck, while still having money leftover each month for yourself.

[1:47] – Ashley Bove’s key to budgeting: the 50/15/5 rule

[10:32] – How to start the budgeting process

[11:44] – How to balance paying off debt while saving up

[00:00:00]

Amanda Greene: Hey, what should we have for dinner tonight?

[00:00:05]

Amanda’s Daughter: Hibachi.

[00:00:06]

Amanda Greene: Oh, that does sound really good. But I meant, what should we make for dinner tonight? We should probably eat at home.

[00:00:12]

Amanda’s Daughter: But it’s so good. And then you won’t have to cook.

[00:00:15]

Amanda Greene: Oh, that’s true. And today has been a really long day. Wait. No, we just went grocery shopping. We need to cook dinner at home tonight. Should we do tacos or pasta?

[00:00:24]

Amanda’s Daughter: My favorite: tacos.

[00:00:26]

Amanda Greene: Okay, tacos it is. Let’s go make them together. You almost had me there for a minute.

[00:00:31]

Amanda’s Daughter: Tacos.

[00:00:33]

Amanda Greene: Welcome to Merging Into Life, where we navigate life’s milestones one episode at a time. Brought to you by AAA Northeast. I’m your host, Amanda Greene. Today we’re going to talk about budgeting. Getting the garbage out on time, staying on top of the dishes, exercising regularly. When I manage to do these things, I feel like I’m winning at life. But I would argue that none of them compare to the glorious satisfaction of staying on top of my money. Having a realistic budget and sticking to it feels amazing. It can be daunting, but it doesn’t have to be. So to make things easy, I’m talking to Ashley Bove. She’s got simple, straightforward ways of tracking what’s coming in, what’s going out and how to get it all under control.

Ashley is a workplace financial consultant with Fidelity Investments. She’s worked with tons of people to wade through the financial and emotional difficulties of making and not breaking the budget. I want to note that the following conversation contains great guidelines and best practices when it comes to budgeting, but does not constitute financial advice. Thanks for being here, Ashley. Let’s take it from the top. What are the key components of a good budget?

[00:01:47]

Ashley Bove: So, we’re going to go back to elementary school with buckets and blocks and start at the beginning. You want to have a bucket for each expense in your life, and we can categorize them. It’s so funny because ‘budget’ is such a scary word. But once we sit down [with clients] and go through it and really look at it, 45 minutes later, they leave and you can just see the relief. So, the way that I recommend to my clients to budget is a 50/15/5 rule.

You look at your take-home pay and you want to make sure that your essential expenses – your housing, your food, your car, everything that’s essential to your life – is less than 50% of your take home pay. So there’s your 50 bucket. Then, 15% should be going into retirement, and that is including an employer match; the goal is to have at least 15% to try to reach a year being contributed to your retirement accounts, whether that’s through a workplace plan or an account on the side. And then 5% should always go to emergency savings with three to six months living expenses. If you’ve already reached that three to six months emergency savings, just a general savings.

[00:03:07]

Amanda Greene: So that’s 50%, 15% and 5%, and that leaves us with 30% to do what with?

[00:03:13]

Ashley Bove: To do whatever you need to do. That is your spending money. If you want to take 10% and put it away so you can have a girls’ night out or have a night out, that’s for you. If you want to put that towards a vacation fund, that’s for you. If you have debt and it’s more than your monthly minimums. Your monthly minimums would be included in your essential expenses because that’s part of your bills, but any money over those minimums, that’s part of that extra 30.

[00:03:41]

Amanda Greene: And you’re saying every dollar should have a job, but I feel like I get lost in the area of miscellaneous. I live in an area of miscellaneous. So tell me more.

[00:03:53]

Ashley Bove: Yes.

[00:03:53]

Amanda Greene: Do you have money assigned as miscellaneous?

[00:03:56]

Ashley Bove: Yep. So that is completely on an individual level. What are your hobbies? What do you enjoy doing? What makes life exciting for you? Every dollar does have a job, but you have to make sure that you’re enjoying your time. You work hard. Yes, retirement is important, paying off debt is important, but if you don’t give yourself a little bit of leniency to have fun and to enjoy what you’re passionate about, you’re never going to be able to stay on budget because it’s going to get to a point where you’re so exasperated and so stressed that you don’t have an outlet to be able to bridge that gap. You need that. That is where that 30% comes in. So, if you dedicate a portion of that to debt, you dedicate a portion of that to a vacation fund, or maybe gifting is something that you enjoy doing, it brings you joy. And that is another area. There you go. That’s where that miscellaneous comes in.

[00:04:56]

Amanda Greene: If you’ve never had a budget before, how do you get started?

[00:05:01]

Ashley Bove: The first step to any of this and what I recommend to everyone– and I hear the sigh of, oh gosh, whenever I say this – pull your bank statements, pull your credit card statements. Everywhere you have spent in the last 90 days, you have to pull. You look at every expense, and this is the worst part. I know you are not alone if this is intimidating and scary, but you cannot move on if you don’t do this step. So pull your 90 days of statements from anywhere that you’ve spent and you have to literally categorize every single thing that you spent on. So you went to the grocery store X amount of times, you spent this much each time in three months. This was the balance for that. You went to dinner and you went out to dinner X amount of times. This is how much you spent. That was the balance for that.

And once you have that, you’ll see exactly where your money is going. You’ll see what’s important to you at that point because it really puts it out there for you. And that’s where you now start to break it down. Okay, I spent $600 on going out in three months at restaurants. Clearly that’s something important. I’m going to budget $200 a month towards going out. And there you go, now you have that bucket. Whether you take that money and you put it into a separate checking account, whether you take it out and leave it on you as cash or whether you put it in envelopes – it’s completely up to you – whatever is going to have the biggest effect on you and the most lasting impact that you will actually follow through with it.

[00:06:27]

Amanda Greene: Sticking with it seems like a difficult part. Do you have any advice about sticking with it?

[00:06:32]

Ashley Bove: It’s hard. Nothing about this is easy, but in the long run it’s so beneficial. And for your mental health alone, to feel like you have it under control and to feel secure, it’s worth it. So my advice as far as sticking with it is having the self-control to make sure you do, to know that at the end of the month you can breathe a sigh of relief. And if you are in a place where you hate that feeling of, I don’t know where my money’s going, I am stressed. Can I afford this? What if this happens? Just having that cushion and knowing that mentally you’ll be in an okay space if you do this, is worth everything. And that motivation after the first month or two should be enough to really push that budget to stick.

[00:07:22]

Amanda Greene: I don’t know if this is too specific, but you know certain expenses are coming every single month. You have your rent or your mortgage, you have your car insurance, maybe a car payment, your cell phone, groceries, you know which ones are coming every single month. But what about the ones that are, I don’t even want to say unexpected, but those too. What about when your child wants to play a sport that’s maybe a seasonal thing? How do you file those into the budget when it’s not a regular monthly occurrence?

[00:07:50]

Ashley Bove: That’s where you would look at where you’re currently budgeting and take away from a different bucket that is on that miscellaneous side, reduce expenses on the essential side, if possible. Or, if you’ve already had your savings account with that three to six months living expenses, maybe take a little bit away from that. It’s just to afford that short-term loss. So it’s not something that you want ongoing. If it’s an ongoing unexpected expense, like your child is starting to become a star gymnast and you need to pay for a gymnastics program for the next 18 years, that’s different. That’s an ongoing expense. That would now go into your essential expenses category. And you have to tweak where your money is going in other places to make up for it.

[00:08:32]

Amanda Greene: It doesn’t matter if you’re making a little or a lot or somewhere in between, you should know where your money’s going.

[00:08:37]

Ashley Bove: Absolutely. And your spending is always relative to what you’re making. So someone who’s making $50,000 a year versus someone who’s making $200,000 a year, their budget is going to be very similar, they’ll just have larger amounts and higher bills in the $250,000 category as opposed to the $50, 000. But everyone needs housing, everyone needs insurance. These are standard bills that everyone has.

[00:09:02]

Amanda Greene: : So your tips for creating a budgeting routine that’s really realistic enough to stick to really depends on preference. Some people are going to like sitting down with a spreadsheet, others might want to stuff envelopes.

[00:09:16]

Ashley Bove: I am a digital person. I like to open my banking app and say, ‘Okay, I have X amount of dollars in this category. I have X amount of dollars for this.’ So I am kind of bank based. So every two weeks when I get my paycheck, it goes into my checking account and then I have it automatically put a set amount into the other accounts based on what my budget is for those. That’s my way. It’s kind of like a cash stuffing, just not physical. So it’s more digital.

[00:09:45]

Amanda Greene: Are there any methods that you see work really well for someone who’s just getting started, maybe opposed to someone who’s really mastered this already?

[00:09:52]

Ashley Bove: Keep it simple. That’s what I would say about budgeting for beginners. You don’t need 17 different categories of budgeting to be able to master it. It’s only 30% that you really are doing yourself, everything else is fixed. That 50, 15 and 5, that’s a fixed amount. So you want to keep it simple. We don’t need a category for nails, and then a category for hair and then a category for going out. It all goes under personal spending. As your bills become higher and as your priorities change, those categories will change. So you want to keep it general so that you don’t get overwhelmed and that it isn’t too much.

[00:10:32]

Amanda Greene: Where do people get stuck in the beginning?

[00:10:35]

Ashley Bove: ‘I don’t make enough.’ That’s what I hear. ‘I don’t make enough for my lifestyle and everything’s expensive.’ And it’s 100% true and I sympathize with that, I understand that. But you will be so surprised that when you actually go through everything, and I hate this, it sounds so cliche, but getting that $5 coffee – yes, it’s fine if it’s budgeted for – but when you’re doing a $5 coffee four or five times a week, you’re at over $ 100 a month, that’s a bill. That’s a bill.

But there are a lot of people that come back and just say, ‘You know what? Life is short. I work hard. I want my coffee.’ And to that, I say, absolutely, you deserve that coffee. You have 30% of your take home budget that you can find an amount to dedicate to that coffee. But that’s it. You want to make sure that at the end of the month you didn’t spend your entire budget on coffee and now you’re stressed out because you didn’t get to go out to dinner with friends or you didn’t get to buy a gift that you wanted to. So it’s really your priorities.

[00:11:35]

Amanda Greene: Truly. That’s something we’ve started saying in our house: We can’t do it all. So where are the priorities?

[00:11:41]

Ashley Bove: Exactly.

[00:11:45]

Amanda Greene: In your opinion, what’s more important? Paying off debt or saving money?

[00:11:49]

Ashley Bove: Paying off debt. You always want to pay your minimums. But the hierarchy of saving is what we call it, or the hierarchy of budgeting, is to make sure you have that three to six months living expenses saved. That is priority. Once your three to six months living expenses is saved, you want to then put as much as you can towards retirement because that’s in the market, it’s growing. Once you’ve hit that ceiling where you’re doing at least the employer match, if you want to then pay off debt, you can. Anything that has over a 6% interest rate is going to be your priority, which right now is pretty much everything. So the interest rate on debt right now is extremely high. Anything over 6% is a priority. That’s what you want to pay down. So to answer your question, yes, paying off debt is important, but it’s equally important to make sure that you are in a space where God forbid something happens tomorrow, you can afford it.

[00:12:43]

Amanda Greene: Ashley, when is the best time to start budgeting and saving? And don’t say when you were younger.

[00:12:50]

Ashley Bove: Yesterday.

[00:12:52]

Amanda Greene: Yesterday. What do you see to people who feel like they’re too late to this party?

[00:12:57]

Ashley Bove: Oh, it’s never too late. It’s never too late. Let’s get started today.

[00:13:01]

Amanda Greene: Can you give an example of the difference it would make to start investing earlier, maybe a 30-year-old who’s listening to this right now, versus someone who does start later though?

[00:13:11]

Ashley Bove: The biggest thing is compounding. But the more you save and the better position you put yourself in, the more you will end up having at the end. So if you think about it, if you invest $100 today and you are young, you’re 30 years old, you have a lot of time before you need that $100, that $100 will grow. Even at 5% per year, it’ll continuously grow. And because you had 30 years of that balance continuously growing at 5% per year, at the end, you’re going to end up with – I’ll just throw a number out there – say $500,000. Now, if you start later, say you are pre-retirement, you’re close to retirement or you’re close to needing that money and you put in $100. If you only have five years for it to continue to grow, you might be at a couple thousand dollars. So the number gets bigger every single month, every quarter, every year. And that interest continues to build, your money starts to work for you. The longer you have, the better. But there is no better time than today to start that process.

[00:14:14]

Amanda Greene: And I imagine seeing it grow is also very fulfilling and exciting, almost as exciting as maybe buying $100 pair of shoes that you really wanted. But knowing that you’re going to be set up later in life could maybe give you that same thrill if you’re watching it grow, right?

[00:14:28]

Ashley Bove: Yes, absolutely. And it’s so funny, I have a teenager, so I have a 14 year old who had her first job last summer babysitting. And she was so upset with me, we opened up a Roth IRA and I said, ‘You’re earning money, we’re going to put a little bit away. Not all of it, just a little.’

[00:14:45]

Amanda Greene: ‘Mom.’

[00:14:46]

Ashley Bove: Oh, she was so mad. And it’s funny, so that was last summer and she forgot about it. And we didn’t put much in there, I think it was $100, nothing crazy. And this summer, she’s starting her job and I pulled up the account and I said, ‘Okay, what are we budgeting to put in there each paycheck?’ And the account said it was up to $137 or something. It had grown. And she was like, ‘Wait, I thought it was only $100.’ And I was like, ‘No, it’s grown, Rosalie. That’s what’s exciting about it.’ And she was like, ‘Oh my gosh, I can afford the backpack I want.’ I was like, ‘No, you can’t.’

[00:15:21]

Amanda Greene: ‘I’m leaving it in there.’

[00:15:21]

Ashley Bove: It’s going to grow. Even just that little amount, seeing that difference and starting young, it made an impact.

[00:15:31]

Amanda Greene: She’s lucky to have you showing her the ropes to start young because it’s easy to be excited about your paycheck and want to just spend it all. But for her to actually have seen it grow year over year, that’s thrilling.

[00:15:43]

Ashley Bove: My biggest piece of advice if you are looking to sit down with an advisor is find someone you connect with. So it is not a one fits all rule. It is not a one fits all personality. Getting into this business, people are like, ‘Oh, you deal with numbers, how intimidating, and math.’ And I always say, this is a people business. I am in this not because I love to see a positive bank balance at the end of the month for clients – which obviously I do – but I love to see, and what internally fulfills me, is seeing someone come in nervous, of course, and then leaving the appointment.

And I can’t tell you how many times I’ve been hugged, I’ve been given thank you cards because it’s just the weight of that stress and having that plan being put into place and just having that camaraderie, having someone that has your back in a lot of ways and wants what’s best for you and is in a judgment free zone. This is not a numbers position, this is a people position. And at the end of the day, that’s all it is, that’s what sitting with a financial planner is, it’s someone who wants you to maximize your dollars for the best of you.

[00:16:53]

Amanda Greene: And not everyone has been given the tools to know how to do that.

[00:16:56]

Ashley Bove: Exactly. My biggest piece of advice along with that is to look at it, whether it’s quarterly, whether it’s semi-annually or whether it’s annually, stay on top of your plan. And if you need to make adjustments, make adjustments, but always have a plan in place.

[00:17:10]

Amanda Greene: I love the way you radiate positivity about the budget. This is really nice and I feel like I have homework to go and do. Thank you so much for coming on today and sharing all of your knowledge in this area. It is very helpful and I feel like I need to go make a spreadsheet now.

[00:17:26]

Ashley Bove: I love it. Absolutely. Thank you so much for having me. It was a complete joy.

[00:17:34]

Amanda Greene: This has been so helpful. First things first, take a good look at what you spend. Pull up your accounts from the last three months and see where your money went. Half of it should be going to necessities, 15% should go towards saving for your future and 5% goes toward an emergency fund. If you have debt, prioritize paying off the bills with the highest interest rates. And like most things, it’s easy to let it stress you out, and it will if you don’t do something about it. So give it a try. Sit down and take a look at where your money goes. Knowing is half the battle and it will be such a relief. Ashley says, ‘The time to start is yesterday.’ And I wish I knew all of this when I was younger. So why wait? Dolly, come here. Can you answer a few questions for me?

[00:18:19]

Dolly: Hello.

[00:18:20]

Amanda Greene: Are you ready, my girlie?

[00:18:22]

Amanda’s Daughter: No.

[00:18:22]

Amanda Greene: If you make money at your lemonade stand, should you spend it all on candy?

[00:18:27]

Amanda’s Daughter: No, I would save it.

[00:18:29]

Amanda Greene: All of it?

[00:18:30]

Amanda’s Daughter: Yeah.

[00:18:31[

Amanda Greene: Let’s start with 15%. We can put it aside for you and you’ll still have some money to spend now. What about if you want candy, should you borrow money to buy it or save up and buy it with money we have?

[00:18:44]

Amanda’s Daughter: Save up.

[00:18:48]

Amanda Greene: Yes, I agree. It’s way more fun to earn the money first anyway. If you do happen to borrow money from your sister, when should you pay it back?

[00:18:56]

Amanda’s Daughter: July.

[00:18:58]

Amanda Greene: Why in July? It’s best to pay it back as soon as you can because paying off your debt is important. When do you think the best time to start saving is, now or later?

[00:19:09]

Amanda’s Daughter: Never. Now.

[00:19:11]

Amanda Greene: Now is correct. What’s the best way to keep track of how much money you have?

[00:19:18]

Amanda’s Daughter: Keep it in your bank and don’t use it.

[00:19:21]

Amanda Greene: Sounds good to me anyway, as long as you’re paying attention to what you have. Is it more affordable to make dinner at home or eat at a restaurant?

[00:19:29]

Amanda’s Daughter: Make dinner at home.

[00:19:30]

Amanda Greene: It is much more affordable to eat at home, and that’s why we’re having tacos here tonight. But you do have a birthday coming up, so why don’t I put aside some money for us to go get hibachi on your birthday?

[00:19:43]

Amanda’s Daughter: Yes, I can’t wait. Thanks, mom.

[00:19:47]

Amanda Greene: You’ve been listening to Merging Into Life, where we navigate life’s milestones one episode at a time. Brought to you by AAA Northeast with assistance from JAR Audio. I’m your host, Amanda Greene. If you’re learning as much as I am, follow us wherever you get your podcasts and leave a review, we’d love to know what you think. Email us at podcast@aaanortheast.com.

The views and opinions expressed in this podcast are not necessarily the views of AAA Northeast, AAA and/ or its affiliates.

Financial Planning in Your 20s and 30s

10 Money Saving Habits to Start Right Now

Smart Personal Savings and Budgeting Apps

Building Your Budgeting Toolbox

Start These Savings Challenges

"*" indicates required fields

*The views and opinions expressed in this podcast are not necessarily the views of AAA Northeast, AAA and/or its affiliates.

Autumn in New York’s Hamilton County is special. The winding roads, foliage-covered mountainsides and lively small towns with cozy lodgings offer a fall full of big experiences and endlessly vibrant scenery.

Take a road trip to see the region’s brilliant autumn colors, discover miles of hiking trails and savor seasonal flavors. For breathtaking views from above, you can climb one of the area’s seven historic fire towers.

Visitors often come to Hamilton Country to ogle the foliage and then discover so much more.

To fully immerse yourself in the natural beauty all around, consider camping. From state-owned parks to the backwoods, there are lots of choices, whether you are pitching a tent or parking an RV. Lake Eaton in Long Lake, for example, provides showers, bathhouses, canoe and boat rentals and easy lake access, as does state park Lake Durant Campground, also with showers and toilets as well as close proximity to the Northville-Placid Trail and smaller trails nearby.

The Adirondack Experience fall foliage report is updated regularly throughout the season, so don’t forget to check before you visit!

With warm days and cool nights, swimming season may be over, but the weather still is perfect for viewing the scenery from a glimmering lake. Canoes, kayaks and other boats are available for rent or purchase at many of the lakeside marinas.

Take time to hike through the woods to discover waterfalls. For a challenge, try hiking up Blue Mountain. You might also want to take part in the Fire Tower Challenge and earn a badge for climbing all seven of Hamilton County’s fire towers. Originally used as lookouts for forest fires, the towers offer unparalleled views of the landscape.

Spend time exploring the small towns in the area, many of them perched along lakes, and enjoy their parks, shops and restaurants. Stroll through downtowns and check out locally owned stores. Blue Mountain Lake is home to Adirondack Experience, a museum filled with stories and exhibits about life in the Adirondacks in 20 historical and contemporary buildings spread over 121 acres.

Inlet offers a charming downtown, public beach and draws waves of snowmobilers in the winter. The town of Raquette Lake, is located on its namesake, the largest natural lake in the Adirondacks.

Raquette Lake is home to Great Camp Sagamore, the former wilderness refuge of the Vanderbilt family from 1901-1954. Many of America’s wealthiest families built rustic estates, complete with the comforts of their urban mansions, in the Adirondacks to escape the heat of city summers. Great Camp Sagamore is open for tours and overnight stays.

Not far away is Great Camp Santanoni in the town of Newcomb, which opened in 1893. Home to Albany banker Robert Pruyn and his family, the camp is located on the Santanoni Preserve, which comprises almost 13,000 acres of the state’s Adirondack Forest Preserve and boasts 5,000-plus square feet of porches facing Newcomb Lake. Unlike the other Great Camps, Santanoni was a working farm for years.

Fall also is a time for festivals and exhibitions, live music and enjoying nature’s bounty. Farmers markets are scheduled throughout the season.

Mark your calendars for the ADK Lakes Theatre Festival, which runs through September 29 and dust off your antlers for the Great Adirondack Moose Festival September 27-29, where you can participate in a moose-calling contest and celebrate the return of the mighty moose to the Adirondacks.

Book a Columbus Day cruise on Raquette Lake Oct. 14 aboard the W.W. Durant, a steamboat-style ship. Later in the season, you can get into the holiday spirit at the Annual Country Christmas Tour, Nov. 22-23, featuring hand-crafted items from the Adirondacks.

Don’t wait until the leaves fall, book your Hamilton County vacation today.

®I LOVE NEW YORK is a registered trademark and service mark of the New York State Department of Economic Development; used with permission.

If you’ve ever watched trees in a storm, you know that it can be scary.

A sunny day can turn into a violent and windy thunderstorm in a matter of minutes. Menacing black clouds creep in quickly, bringing strong winds that push the trees around, swaying them back and forth and carrying away leaves and small branches with ease. Hurricanes, though more predictable, can come on just as fast and with even more force.

Trees are used as a gauge for defining how powerful a storm is, not only to the average person, but in meteorological storm categories and wind measurement. The intensity of a storm can be determined by observing the wind in the trees, how it moves the branches and if it is strong enough to uproot even the grandest of oaks.

It’s a helpless feeling when uncontrollable forces of nature are at work and all you can do is cross your fingers that a heavy branch or tree won’t fall on your home or car. Of course, if you ever do experience tree storm damage, your insurance can help.

Structural damage caused by branches and trees falling in a storm is one of the most common homeowners insurance claims during hurricane season, as well as in the winter due to blizzards and heavy snow.

As a homeowner, it is your responsibility to perform regular maintenance to your home and property to avoid potentially dangerous situations. This includes pruning and trimming tree branches that are weak or hanging over your house and removing dead or dying trees. Hire a professional to take care of the big jobs ahead of hurricane season as part of your seasonal home maintenance in the spring.

First and foremost, if a tree falls on your home, evacuate immediately, make sure everyone is safe and call 911. If you can do so safely, cover up any openings caused by the fallen tree with a tarp or something similar.

“If a tree hits your home or other insured structure, such as a detached garage, your standard homeowners insurance policy covers the damage to the structure, as well as any damage to the contents,” according to the Insurance Information Institute.

Keep in mind that poor maintenance is taken into consideration when reviewing claims. If your insurance company determines that storm damage could have been avoided by proper upkeep, such as failure to remove a dead tree, it may not be covered.

Living Arrangements

In some cases, the destruction may be so bad that your home could be deemed unsafe to live in and you may need to make other living arrangements. “Your home insurance may also help you cover additional living expenses if you need to reside elsewhere while repairs are being made,” said Jodi DeSantis, vice president of insurance for AAA Northeast.

Car Coverage

If a tree falls and causes damage to your vehicle, it will be covered if you carry comprehensive – sometimes called “other-than-collision” coverage, on your policy. Policy deductibles (the out-of-pocket limit that you are responsible for paying) will apply.

Power Loss

Imagine stocking up on bread, eggs and milk before a storm, just for it all to go to waste because of a power outage. Falling trees and branches often cause prolonged power losses, but many people don’t realize that they may be able to get reimbursed for the cost of lost groceries.

Check with your insurance agent to see if you have food spoilage coverage on your homeowners policy. If not, it is relatively inexpensive to add. “It is well worth the dollars. And most insurance carriers will waive your deductible when this coverage is utilized,” said DeSantis.

If you do experience a power outage, maintain the temperature of your refrigerator or freezer by keeping the door closed as much as possible. Once power is restored, check all your refrigerated foods for freshness; if there is any doubt, throw it out!

Get more tips on how to handle a power outage.

Neighbors’ Trees

What if a neighbor’s tree falls and damages your property? Because a healthy fallen tree is considered an act of God, the person who sustains the damage is the one who will file the insurance claim and be covered by their insurance. However, your neighbor may be held liable if the tree was knowingly in poor condition or deteriorating. Just another reason why it’s important to stay on top of tree maintenance.

Storm Damage Tree Removal

If a tree falls on your property and causes structural damage, repairs as well as tree removal may be covered by your insurance. If the fallen tree does not hit a structure, there may not be coverage for debris removal, except in certain situations like if the tree is blocking a driveway or handicapped ramp.

Have you ever experienced storm damage from trees? Tell us about in the comments.

Discuss homeowners insurance with a AAA Insurance agent today.

This article has been updated and republished from a previous version.

People tend to lump all electric vehicles into one pile, but consumers may not realize different types of EVs have varying degrees of electrical dependence, including models that could appeal to those who are reluctant to go all-electric.

Despite efforts by state and federal governments to promote electric vehicle sales, many buyers remain hesitant to transition from traditional gas cars. According to AAA’s latest EV survey of drivers in the Northeast, range and charging infrastructure remain primary concerns.

AAA research has found that consumer interest in EVs lacks enthusiasm nationwide, however, 1 in 3 drivers would consider purchasing a hybrid.

Part of what keeps drivers from committing to an EV is simply not knowing their options, even when it comes to the basics. For example, it’s common for people to miscalculate how an EV will fit in with their personal driving habits.

“Most people drive fewer than 100 miles a day and almost every EV on the market today can cover their daily needs without stopping to charge,” said March Schieldrop, senior public affairs spokesperson for AAA Northeast. “When someone buys an EV, one of the big realizations is that they almost never rely on public charging and nearly all their charging occurs overnight at home.”

Range anxiety, or the fear of running out of battery charge, might be more of a concern for long trips, but even then, planning ahead can help.

Many are also unaware of the different types of EVs and how they operate. What is the difference between a battery electric vehicle and a hybrid? Or a hybrid versus a plug-in hybrid? And what do charging terms like Level 1, Level 2, Level 3 and supercharging mean?

Electric cars require a bit of homework, so we’ve compiled this explainer to help. You may still be on the fence now, but an EV could be in your future.

President Joe Biden signed an executive order in December 2021 for the U.S. government to end the purchases of gas-powered vehicles by 2035, but “mass adoption will take time,” said Schieldrop. “The average car on American roads is now more than 12 1/2 years old. Even if gas-powered cars are no longer sold in this country in 10 years, it will take decades for every car on the road to be an EV.”

The type of battery used in most EVs due to its high energy density and ability to be continually recharged.

An electric current that continually changes direction. It is the standard electrical current in homes.

An electrical current that flows in one direction. It is the type of current that comes from a battery. When being charged by AC, EVs convert the power to DC to replenish their batteries.

A system found in most EVs that captures the energy created by braking and transfers it to the car’s battery.

A type of car that uses both an internal combustion engine and an electric motor for improved fuel economy. Hybrids do not require an external charging source to charge. The gas engine generates enough electricity to charge the battery while driving and also gets a boost from regenerative braking.

A hybrid that can also be charged externally. Plug-in hybrids get some of their charge from regenerative braking, but as the name suggests, can also be plugged into a power source. They can travel as far as 40 miles on electricity alone.

A vehicle powered entirely by an externally charged electric battery.

Powered by hydrogen, these environmentally friendly cars produce no harmful emissions, just water vapor. They’re available in limited markets due to lack of infrastructure.

A vehicle that emits no exhaust gas or other pollutants while in use, which inclues all of the above.

The slowest form of charging, Level 1 is usually done at home using a standard 120-volt household outlet. Level 1 charging takes several hours to fully replenish an EV battery. Never use a Level 1 charger with an extension cord.

Level 2 charging is significantly faster than Level 1, adding roughly 20 to 50 miles of range per hour. Level 2 chargers must be professionally installed for residential use. Most public charging stations are Level 2.

Also known as DC fast charging, Level 3 is capable of high-power energy transfer that can replenish an EV battery to 80% in a half-hour.

Tesla’s proprietary EV charger can add up to 200 miles of range in as little as 15 minutes, according to the automaker. This fast-charging standard is called the North American Charging Standard (NACS). Tesla owns and operates a network of more than 35,000 superchargers across North America.

A converter that changes the car’s DC energy back into AC electricity so it can power something else, like appliances, another EV or even a house. This also requires a device to disconnect the house from the electrical grid so it can be connected to the vehicle.

Also known as a J plug or Type 1 plug, this five-pin connector is widely used in North America and supports both Level 1 and Level 2 AC charging.

The CCS1, which stands for Combined Charging System Type 1, features a seven-pin configuration, integrating the SAE J1772 connector with two additional pins, allowing it to support both AC and DC charging.

This connector, which is used for DC fast charging, is found on models from Asian manufacturers.

Select EVs other than Teslas can connect to Superchargers using an NACS adapter. However, many major automakers, including Ford, General Motors, Nissan and Mercedes-Benz have recently adapted the fast-charging standard and will be transitioning all new EVS to come with built-in NACS charge ports.

To learn more, visit AAA’s EV website.

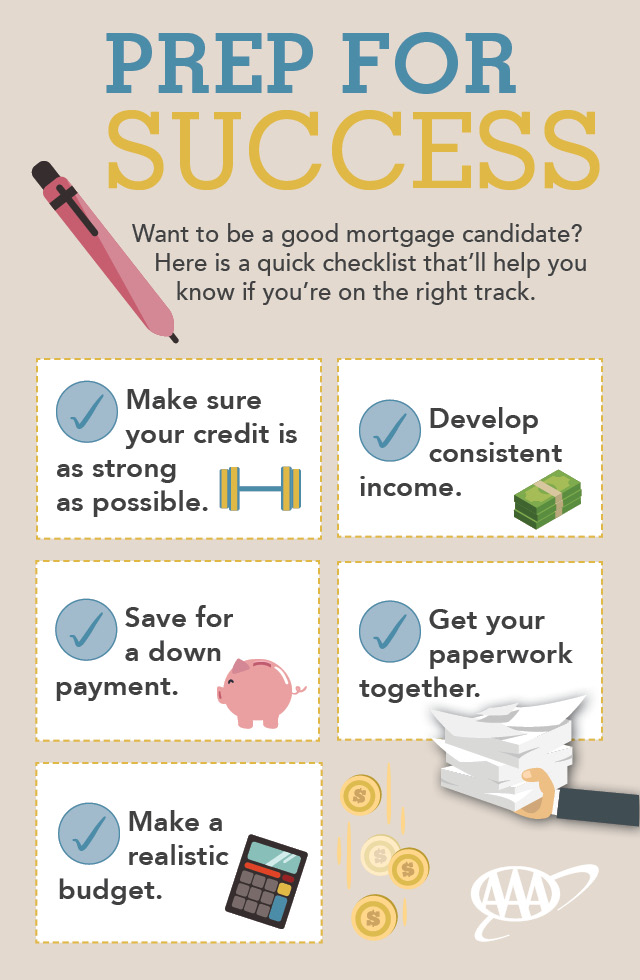

Applying for a mortgage loan can be a dream come true or a real wake-up call. The difference is how well you prepare.

Getting your ducks in a row before applying for the biggest loan of your life is important if you want homebuying to be the wonderful experience it should be. It’s not something you can do overnight, either.

Becoming a quality mortgage candidate is something that can take years. Here are some of the steps you should take.

One of the best ways to show you’re prepared for a mortgage loan is through strong credit. The basic principles of building good credit are: always pay your bills on time, be careful about opening and closing new lines of credit and don’t use a high percentage of your available credit.

A good way to know how you’re doing is to review your credit report. Every consumer is entitled to a free copy of his or her credit report once a year from each of the nation’s three leading credit repositories. Click here for details on getting your report.

Credit scores are numbers that help tell lenders how likely borrowers are to consistently make loan payments. There are some credit card companies that offer customers free access to their scores. It’s important when reviewing these scores to remember that there is no single credit score.

FICO is one of the most popular credit scores, but it might not be the figure a lender is using to determine your credit worthiness. Lenders use a variety of algorithms to determine applicants’ credit scores, and they can vary depending on the type of credit you’re applying for.

Think of your credit score as more of a ballpark estimation of your credit worthiness versus a cold, hard figure.

Having a low credit score can have varying degrees of consequences. If your credit is too low, your mortgage application may be denied. If your credit is good, you may be approved but at a higher interest rate than someone with excellent credit. Some credit scores may also limit your eligibility for loan programs. Mortgages through the Federal Housing Authority, for example, tend to have lower credit thresholds than traditional mortgages.

A steady income goes a long way toward proving you’ll be able to make payments on your mortgage loan. Applicants with consistent work histories often fare better than those who have recent gaps in their work histories.

Don’t overextend yourself. Lenders typically will allow your monthly debt to go up to 43% of your gross monthly income. But consider your lifestyle. If you have upcoming expenses like college for a child or possibly a new car purchase, you may want to dedicate less toward a mortgage payment..

Borrowers who make large down payments are often seen as lower risks than borrowers who make small down payments. In fact, homebuyers who aren’t prepared to put 20% down should be prepared to pay for mortgage insurance. It’s a fee often added to your monthly mortgage payment like homeowners insurance, and it protects a lender in the event a borrower defaults. If you don’t think you can put aside even a small down payment, like 3.5%, you may be eligible for a government-insured mortgage program that permits relatives to gift you money for a down payment.

You’re going to need quite a few documents to close on your mortgage. Getting all your paperwork together as early as possible can help. Have at least have two or three recent paystubs, tax returns from the last two years and bank and debt statements.

For faster, more personalized service to secure your mortgage, consider using a mortgage broker with AAA.

Learn more about AAA mortgage loans and other home loan services.

Visiting the Northeast in autumn is the best time to enjoy the cool, crisp air, fall-themed foods and the most vibrant changing foliage.

When planning a trip around leaf peeping in New England, where you stay matters. With excellent locations, amenities and price point options, a hotel by Wyndham has everything you need. With a collection of 25 trusted brands, Wyndham Hotels & Resorts welcomes travelers for all types of trips, from airport layovers to beachfront getaways and everything in between.

If you’re looking for a place to stay in and around New England this fall, here are our top Wyndham properties to book.

Maine is one of the first states where the leaves begin their fantastic color transformation. The Hawthorn Extended Stay is situated perfectly near gorgeous Acadia National Park and charming downtown Bar Harbor – both must-see locations. Guests enjoy free breakfast during their stay, a heated indoor pool, free Wi-Fi and convenient distance to both local airports, so getting there is a breeze. This contemporary hotel is also dog-friendly*, so bringing your furry friend along to enjoy the foliage is no problem at all.

Not only is Boston’s central location ideal for a range of leaf-peeping destinations within the region, but it’s also one of the most picturesque cities to see in the fall. Make Wyndham Boston Beacon Hill your home base, situated in the heart of the city with proximity to some of Boston’s top attractions like award-winning restaurants and TD Garden. Valet parking**, pet-friendly rooms* and a rooftop pool only scratch the surface for the thoughtful amenities you’ll enjoy during your stay.

While enjoying your leaf-peeping adventure in Rhode Island, the breathtaking scenery is just the start. Book an idyllic New England escape at the Wyndham Newport, where hospitality takes center stage. Enjoy inspired local fare at the onsite restaurant, take a dip in the heated saltwater pool, relax beside the outdoor firepits or sunset patio in the evenings and get to where you need to be downtown by shuttle – for free.

Although not technically part of New England, New York is on many leaf peepers’ lists. As you explore the region, head to Lake George to catch waterside views of the leaves. A comfortable stay at La Quinta Inn & Suites provides free parking, free breakfast, a fully equipped gym, basketball court, hot tub, game room and more. Newly opened in 2023, this modern hotel allows you to make the most of your stay in Lake George as it’s merely minutes away from popular restaurants and activities like wineries, horse racing and plenty of family fun.

Going somewhere else this fall? Explore Wyndham Hotels & Resort’s locations worldwide. AAA members save 10% or more on hotel stays.*** Book now by calling 800-789-4103 and mention you are a AAA member or visit WyndhamHotels.com/AAA.

*Additional pet fee may be charged

**Additional valet fee may be charged

***Restrictions apply.

Vacations can sometimes seem like a tug-of-war between those who want to get out and explore, and those who just want to chill out. In Costa Rica, there’s no need for competition, because everyone wins.

“Wherever you are in Costa Rica you can have a different experience,” said Jodi Abata, a AAA travel advisor based in Wayne, N.J. “It’s not just a beach destination. There are rainforests, an active volcano and exotic plants and animals. It’s an amazing place for families with ziplines, horseback riding, thermal baths and more.”

Costa Rica’s location explains its best-of-all-worlds reputation: This Central American nation has Pacific and Caribbean coastlines separated by a mountainous interior. The latter is covered in dense jungle and rainforests alive with four species of monkeys, tree sloths, toucans and more.

The phrase “pura vida” can be seen and heard throughout Costa Rica. Though it directly translates to “pure life,” its meaning goes much deeper. Used as both a greeting and a farewell, it encompasses the positive spirit of Costa Rican culture. It represents enjoying the simply things, connecting with and respecting nature and being grateful for every day. Come experience it!

Your Costa Rica vacation is just a click away. Book now.

Both coasts of Costa Rica have beautiful beaches but offer distinctive experiences.

While all-inclusive resorts are strongly associated with the Caribbean, in Costa Rica, the big resorts are located on the Pacific Coast in Guanacaste and Puntarenas provinces.

Costa Rica’s shorter Caribbean shoreline, entirely contained within Limon province, is far less developed and home mostly to villas and boutique hotels.

In Guanacaste, for example, you can vacation at the family-friendly, AAA Four Diamond designated Planet Hollywood Costa Rica, an all-inclusive Marriott Autograph Collection property. Or splurge on a couples escape to the Four Seasons Resort Papagayo, the adults-only, all-inclusive Secrets Papagayo or the Andaz Costa Rica Resort at Peninsula Papagayo.

Costa Rica’s excellent road system allows visitors to move freely around the country, and many travelers choose to mix a relaxing beach stay with adventurous explorations in the country’s interior, said Abata.

Arenal Volcano National Park and the spectacular La Fortuna Waterfall, two of Costa Rica’s most popular backcountry destinations, are under three hours’ drive from Limon and under four hours by road from Guanacaste.

The park and surrounding Arenal Conservation Area are home to their namesake active stratovolcano – lava has been flowing here regularly since the 1960s! Hiking trails trace the path of the major eruption of Arenal volcano in 1968 as well as crossing a series of hanging bridges suspended in the rainforest canopy. Here, the dormant Chato volcano is also protected, with its crater lagoon, Lake Arenal.

Nearby lodging like the Springs Resort and Spa and Nayara Springs let you immerse in volcano-heated hot springs after a day of hiking and exploring.

While Costa Rica’s Caribbean coast is best known for low-key relaxation, there’s no shortage of activities when you want to get off the beach. Tortuguero National Park, named for the leatherback sea turtles that nest there, is full of rivers, canals and lagoons; it’s about two hours north of Limon by road.

Cahuita National Park is about half the distance away from Limon and preserves many of Costa Rica’s diverse charms in one place: Pristine beaches, coral reefs teeming with fish and rainforests where hikers may encounter tree sloths and raccoon-like coatis. To immerse yourself in local culture, head to the town of Puerto Limon, known for its rich Afro-Caribbean heritage.

Corcovado National Park, one of the most biodiverse places on the planet, is located on the isolated Osa Peninsula on Costa Rica’s southwest Pacific coast. Six native wild cats including oncillas, margays, pumas, jaguars, jaguarundis and ocelots mostly inhabit this remote area. It’s a long drive from anywhere, but a flight from the capital of San Jose to Drake Bay, about an hour from the park, takes 40-50 minutes.

Hiking is required to see some of Costa Rica’s most singular sites, but it’s not all hard work. The country abounds in ziplines and canopy tours. Zoom over tropical dry forests toward the Guanacaste coast on Diamante Eco Park’s Superman Canopy Zipline or hang like a spider monkey over a Pacific coast jungle with the Rainforest Adventures Aerial Tram in Jaco. The Arenal reserve offers thrilling ziplines and easygoing canopy tours, as well.

Exploring on horseback is another less strenuous way to enjoy Costa Rica’s natural beauty, with guided rides available along the beaches and into the rainforest.

Environmentally conscious and unspoiled, Costa Rica is a welcoming destination for Americans where English is widely spoken and the U.S. dollar is always accepted.

“It’s a beautiful country, with very nice people and a very safe place,” Abata said. “Costa Rica is its own little world.”

Did you know your AAA membership grants you access to your own travel team? Plan your Costa Rica vacation with the help of a trusted AAA travel advisor and customize your trip from start to finish. Call 866-423-5585 to speak with an advisor today!

Have you been to Costa Rica? Tell us what you love about it in the comments below.

If you’re shopping around for a used vehicle, there’s a good chance you are going to come across a flood-damaged car, whether you realize it or not.

Insurance companies often declare flood-damaged vehicles as total losses, and those cars are then sold to salvage companies. However, rather than being dismantled for parts, some of these vehicles are purchased by individuals who restore them to some degree of working order. AAA warns car buyers that water-damaged vehicles can be transported anywhere for resale.

Thousands of flooded cars make their way back to the used car market each year and that number often increases following hurricane season and major floods.

So, how do you know if you’re on the verge of buying a flood car? Start with the vehicle’s description. It may be referred to as “storm-damage” and could have a new title indicating it was an insurance total. Car history reports can help, but only if the car was put through a claim process.

Here are some other ways to check for water damage:

If you are caught in a few inches of water, your car will most likely be fine. If the water leaked into the vehicle’s interior, however, there may be real trouble.

Here are some tips and steps to take if your car becomes flooded.

Have a question about flood-damaged cars? Leave them in the comments below.

Get a pre-purchase inspection by a trusted mechanic. Locate a AAA Approved Auto Repair facility near you.

SEASON 1: EPISODE 9

Episode Feedback

This episode is your ultimate guide to moving out for the first time. Whether you’re renting or buying, it’s all yours to do as you please.

You get to decide how to decorate, when you’ll do the dishes and if you’ll eat on the couch or at the dining room table. But, with great power comes great responsibility, so you might have to move your own stuff as well. No need to stress, we’ve got everything you need, from a moving out checklist to additional tips to ensure a smooth transition.

Our guests Rob Shetler, Vice President at Shetler Moving & Storage, and Jami Supsic, Home and Style Director at HGTV Magazine, join us to share their professional insights. They cover how to make the most of your new space, whether the couch will fit through the door, and the essential things to buy for your first home.

[5:38] – How to make sure your furniture fits your new space

[7:19] – Key things to consider when using a moving company

[13:21] – How to make the most of a small space

[16:38] – How to find affordable furniture

[00:00:02]

Amanda Greene: Hey, how are you? What are you doing?

[00:00:04]

Friend: Good. Not much. What are you doing?

[00:00:05]

Amanda Greene: I just sent my niece some money. She’s moving out for the first time. Can you even believe that?

[00:00:10]

Friend: Oh my gosh. Wow. I can’t believe she’s old enough to be out on her own.

[00:00:14]

Amanda Greene: I know. Do you remember our first place?

[00:00:16]

Friend: I do. We had so many paper plates and I brought the weirdest stuff from my college dorm room like that floor lamp that has all the different color arms coming off of it.

[00:00:28]

Amanda Greene: With different color light bulbs. Do you remember that?

[00:00:31]

Friend: I like to think we’ve developed better taste since then. And I wonder what your niece will end up doing.

[00:00:36]

Amanda Greene: She’s probably going to end up fighting with her roommate about whose turn it is to do the dishes or why there’s clumps of toothpaste in the sink, and they’ll probably end up eating way too much takeout like pizza every night.

[00:00:48]

Friend: I mean, some things never change. I still order pizza on the daily.

[00:00:55]

Amanda Greene: Welcome to Merging Into Life where we navigate life’s milestones one episode at a time. Brought to you by AAA Northeast. I’m your host, Amanda Greene.

Today, we’re going to talk about moving out for the first time. It’s funny, moving into my college dorm was one thing, but my first place was totally different. Me and my roommate were exclusively responsible for everything. All of a sudden we had to cook, clean, decorate and pay our own bills. It was a huge learning curve, but it was also exciting and was an important step on the way to being a fully formed adult. Learn by doing, right? And there was so much freedom. But as we all know, with the freedom of adulthood comes the massive responsibilities.

So let’s go over how to do it right, how to pack up and make the move, and how to make the place our own once we move in. We’ll be speaking with Rob Shetler, a veteran in the moving business

But first…

[00:01:53]

Jami Supsic: So I’m Jami Supsic, the home and style director at HGTV Magazine. And that means I really find the house tours that we feature in every issue and produce the photoshoots and styling for those house tours. And then I also practice interior decorating.

[00:02:08]

Amanda Greene: Beautiful. Well then you sound like the perfect person to talk to about moving out for the first time and curating your own personal style. But first, do you remember your first apartment? What that like?

[00:02:19]

Jami Supsic: My first post-college apartment will always have a special place in my heart. I moved out to LA from the East Coast with two of my best girlfriends from college, and we rented this two bedroom apartment that we converted to a four bedroom with plywood. And I look back when I was thinking about this interview, I’m like, “Wow, we just nailed plywood to the wall to separate rooms, and we never asked the landlord.” I would never recommend that now, but it was a great space and it was a really fun time. But even then we did take care to decorate it.

[00:02:53]

Amanda Greene: Just to be on the safe side, I want to add that at no point should you do anything to your rental without checking with your landlord first, painting, drilling holes, anything that might be an issue should be approved. And if you’re thinking of nailing plywood up to act as walls, just don’t. But back to decorations.

When thinking about planning your space, the space that you’re going to live in, and you finally have this freedom and independence and you’re moving out, how can people start planning how they want to set up their space?

[00:03:29]

Jami Supsic: I think that when you’re thinking about this first space that you’re moving into, your first adult place, you kind of want to think about what is your style. What I find is a really good trick for people to get inspired and to see what they like is to do fun stuff like browsing through magazines or online and just start pulling things that you react to and don’t think anything other than that. Just pull a bunch of stuff that inspires you. And then once you’ve kind of got a good stack of that, go through and see what the common theme is. And there will be a common theme.

You might be like, “Wow, every single bedroom I pinned is pink.” And then you’ll start to realize, “Oh, maybe I really like these pink bedrooms.” Or you’ll start to see, “Everything I’ve pulled has a sectional in it. Maybe I want to make sure that wherever I’m moving has room for a sectional.”

But then also you should think about how you want to live, right? This is very exciting. This is your first place. Do you picture having friends over for gaming night? Do you want to have a Halloween party every year? Thinking about how you want to live there and then what that means in terms of execution. If you want to have dinner parties all the time, how are you going to fit a dining table in this space that you’re getting?

[00:04:38]

Amanda Greene: Speaking of fitting things, I don’t know if it’s my imagination or what, but doesn’t it seem like things like couches and just furniture in general are bigger than doorway space is providing these days? Is that a thing?

[00:04:52]

Jami Supsic: Yes. Oh gosh, especially living in New York City, this is a nightmare scenario. You have to measure and measure twice because you have to think about, “Is this going to fit through your doorway?” If you’re moving into an apartment, is it going to fit in the elevator? And if you don’t have an elevator, is it going to fit in the stairwell? And that’s really tricky. I mean, even for me, and I’ve been doing this for a long time, there have been things that don’t fit. So you do want to take that time to measure and make sure whatever you’re bringing with you fits through the door. In New York City, we have companies that specialize in cutting your sofa, but that’s not cheap and I don’t recommend that.

[00:05:30]

Amanda Greene: Wow. Okay. So really important. Before you even move into your space, you need to plan for it. So we need to measure two or three times and then check those measurements too.

[00:05:40]

Jami Supsic: Grab some graph paper and draw a floor plan. And it’s kind of fun. Something that I still do to this day even with floor plans, I’ll actually outline things on the floor to see how they’ll fit. Get your tape measure, get your painter’s tape and just tape the floor and see how it fits in the room. If you have dreams of a king bed, don’t buy the king bed without making sure it’s going to fit in your bedroom. And the same thing goes for a sofa. You don’t want a living room that just has a giant sofa and nothing else in it.

[00:06:10]

Amanda Greene: Jami is great at helping us decide how to make our first place nice and we’re going to come back to her, but let’s not get too ahead of ourselves first. We have to get there. Moving is notoriously stressful. Packing up and transporting everything you own in a short period of time is not easy, but it can and is done all the time by Rob Shetler of Shetler Moving & Storage.

[00:06:38]

Rob Shetler: My family, we’ve been in the moving business for 125 years. We’re one of the founding agents of Atlas Van Lines, and I run our operation in Cincinnati, Ohio.

[00:06:48]

Amanda Greene: What’s the most interesting thing you’ve ever moved?

[00:06:52]

Rob Shetler: The needle on top of the Empire State Building. We moved all that up to New York.

[00:06:57]

Amanda Greene: Claim to fame.

[00:06:59]

Rob Shetler: I mean, it’s not just household goods. We move anything and everything.

[00:07:03]

Amanda Greene: I feel like this is next-level adulting, the act of moving without bribing your friends with pizza to help you. Like, actually hiring a company to help you do it. But regardless, moving is stressful. And if you hire a company, how do you choose who to go with?

[00:07:19]

Rob Shetler: Well, if they’re worried about choosing a mover, the Federal Motor Carrier Safety Administration is a good place for a person to start to make sure that the company they’re talking to is a licensed company. They have a Department of Transportation number, they actually have an address. One of the things that Van Lines fights all the time are rogue movers. Small moving companies can be licensed properly insured, and they do a fantastic job. It’s the guys that are out there that don’t have a license, don’t have DOT numbers, just fly-by-night companies.

[00:07:48]

Amanda Greene: What’s the worst thing that could happen?

[00:07:52]

Rob Shetler: Worst case scenario, they never see their household goods again. It’s always good to get three estimates. If you get three estimates and they’re all fairly close, then all of a sudden one of them’s half the price, it’s something to reconsider there I think.

[00:08:04]

Amanda Greene: Something to keep in mind is that what movers will cost you has a lot to do with weight. And there are other factors like is there elevator access or stair access? Can a large truck park outside your house or is it limited access? And a small truck has to shuttle your stuff out of the neighborhood. Then there is distance and the cost of gas. All in, Rob says a small one bedroom move could be as little as about a thousand dollars, but an entire house could cost easily $15, 000 to move. So decluttering is important and economical, but don’t wait to do it until the last minute. I remember the last time that I moved, I actually watched videos to get an idea of the better way to pack our stuff because I’m wrapping things in towels and I mean, it was just kind of crazy. Do you find that people underestimate how much stuff they have or how much time they should give themselves?

[00:09:01]

Rob Shetler: We run into it on a daily basis where customers say they’re going to pack themselves and the driver gets out there and half the house is not packed up. They get to a point where they’re just overwhelmed and they’re exhausted and then we have to come in and finish the packing. Packing takes time. For a moving company to pack, we’re a lot faster at it, so we’re going into a closet or anything. We’re packing everything up into wardrobe boxes, whatever it may be. If a customer’s packing themselves, they’re slowly going through and everything, which I think is a good idea to pare things down, but it takes a lot longer for them to pack than it does for us to pack.

[00:09:33]

Amanda Greene: There’s more emotion attached to the stuff.

[00:09:35]

Rob Shetler: Absolutely. It’ll start reminiscing and they say, “Oh, look at this.” So it happens almost every move.

[00:09:41]

Amanda Greene: Talking packing, are there any items that you would suggest someone take themselves and move personally, even if they’re using a moving company? Any specific items that you might say you might want to hang onto that and move that yourself?

[00:09:54]

Rob Shetler: Yeah. We give customers a moving checklist that helps them prepare for the move, but also lists out things that we want them to take. We want customers to take documents they need to get their hands onto: birth certificates, passports, insurance, stocks. They’re heading to the closing of a house. They need to have all their closing documents. If it’s inside the truck, it’s not going to be an easy thing to find. Medicines, jewelry, money, high-value items like that we want them to take. If they have small children and there’s a blanket or toy or whatever, they better set that aside. So we always direct people to set certain things aside, designate a closet or portion of the house where they can put everything that they’re going to take with them in the car or on flight, and then that’s off limits to us, and then we come in and pack everything else up.

[00:10:38]

Amanda Greene: We found books were the biggest pain point during the moving process. Do you have any hot tips on how to move books, how to store them? They’re so heavy.

[00:10:49]

Rob Shetler: Well, we don’t want books packed in a box any larger than a one and a half cubic foot box or in an office, you see the box for paper.

[00:10:57]

Amanda Greene: Yeah.

[00:10:58]

Rob Shetler: We don’t want books in a box any larger than that because to your point, they’re heavy. You put them in a box, that’s too heavy. It takes two people to carry a box and the box can’t hold that kind of weight. People get connected to their books and they don’t want to get rid of them. And I understand that. At the same time, when we move somebody, on an interstate move, it’s all based on weight. So if you have a lot of books, your weight jumps up considerably.

[00:11:18]

Amanda Greene: Ooh, that’s a really good tip. You might save money by taking your books yourself or paring down the books before you even begin packing. That’s a really good tip. I’m so glad that you’re here and I can ask you this question because it’s something that’s come up a number of times for myself, for friends. Gratuities and tipping. Let’s say you had an amazing experience and you’re feeling really grateful for the service you had provided, and the movers are there and they’re getting ready to leave. Are we tipping? Is it a certain amount?

[00:11:46]

Rob Shetler: It is not unusual for our drivers and our crews to get tips. $ 50, $ 20, $100. It just depends on the size and distance. Some of our customers, they buy them lunch every day. They’re in their homes for two to three days packing and loading, and then they get to destinations. So they spend several days with the crew, so they almost become friends with them. And I would say anywhere from $20 to $100 generally per person.

[00:12:11]

Amanda Greene: So if you want to leave a tip, that’s a great guideline. Thanks so much for the information, Rob. Okay. We need to pack books in small boxes. Get organized well before you need to because it’s going to take you longer than you think. And always use a reputable company. All great advice.

So let’s just say your old place is packed up and empty. Everything is on its way. How do you prep your new home? Let’s check back in with Jami. What are some things that you should buy before you move in and maybe some other things that you should wait to buy until you’re more settled in and you are more familiar with your space?

[00:12:50]

Jami Supsic: I think a great thing to buy before you move in are rugs because you don’t want all of your furniture to come in and then have to move it all out and put the rug down. And I know that maybe rugs sound fancy, but there’s so many great affordable options out there. They really make a space cozy. They really hide ugly floors and they block noise and help with your downstairs neighbors from complaining if you’re coming home at 1:00 a.m. in heels or having friends over. So that’s definitely something to think about.

[00:13:20]

Amanda Greene: Okay, so a lot of apartments, as we mentioned, especially your first apartment, can be on the smaller side. Mine was a studio apartment in New York and it was tiny, literally one room. I mean, truly a true studio.

[00:13:34]

Jami Supsic: There’s lots of hacks you can do to maximize smaller apartments. I think sofas with single cushions are much more practical than sofas with multiple cushions because you can pile more people on there or if you have an overnight guest, it’s much more comfortable for someone to sleep on a sofa that just has one cushion versus multiple. So look, you have an instant guest room right there. If you can’t fit a dining table, I suggest maximizing your coffee table, kind of getting the largest one that you can that will make sense in there. Getting something that you can have your dinner on every night, have game night, have friends over. I think beds with under storage are awesome, ones that come with drawers, those hold so much stuff. And then even just getting storage bins for under your bed. But if you can get a bed that has under storage, those are amazing in studio spaces or smaller spaces.

[00:14:25]

Amanda Greene: Let’s talk color palettes because I want to say over maybe the last five years or so, gray has been everywhere and people are starting to want to incorporate more color back into their homes to reflect their personal style, their preferences. How do you decide on a color palette?

[00:14:42]

Jami Supsic: Gray was everywhere. Gray and stark white were really the thing for a long time. People are embracing warmer tones like brown and beige again. I never thought we would see beige paint on walls, but a lot of paint brands have pre-existing palettes, so they’ll have multiple options if you go to a paint store and they’ll have five different curated palettes where you with five different colors that you could use throughout your space. Most of these paint companies have these amazing apps where you can upload an image of your room and then try out different colors, or you could say, “Oh, I have a blue rug and a yellow lamp.” And then they’ll suggest other colors that would go with that. So those resources are amazing. I highly suggest using them. And then when it comes to painting, if this is a rental, you do want to check with your landlord to make sure if that’s okay, and you’re probably going to have to paint it back when you leave.

[00:15:35]

Amanda Greene: What’s another essential interior design consideration that you think every space needs?

[00:15:42]

Jami Supsic: I think every space needs a mirror. You want a really big mirror if you can. You need great lighting. You can’t only rely on overhead lighting. You need lamps, especially in your bedroom, at least one lamp in the living room. It’s just cozier and nicer and you need good light bulbs. Under no circumstance should anybody ever buy cool white light bulbs.

[00:16:04]

Amanda Greene: Okay.

[00:16:05]

Jami Supsic: They’re so harsh and they’re not going to make you look better. They’re not going to make this space look better. Always when you’re buying light bulbs, look for the ones that are the warm or soft in the description or amber.

[00:16:15]

Amanda Greene: Okay, so you feel strongly about a warm light?

[00:16:19]

Jami Supsic: Yes. And then I think, yeah, just personalize your space. Add some cute throw pillows. If you love plants, have some plants in there.

[00:16:27]

Amanda Greene: Furnishing a new apartment can be very expensive. So do you have any tips on how people can save money on things like furniture?

[00:16:35]

Jami Supsic: Yeah, I think that there are so many used furniture sites now. Even in my first apartment, back in the day I was finding things online. Buying from your neighbors or from estate sales or yard sales is really a great option. So I suggest scouring these marketplace sites that have secondhand furniture. And don’t be afraid to bargain. Don’t be afraid to ask the origin, ask questions, but that’s a great option. And one tip I will say that I’ve noticed is if you buy something that is a name brand and then say years later you go to sell, it holds its value. It’s going to go more quickly on these resale sites. What I do is I screenshot everything I buy so that later if I have to sell it, I can say, “Look, here this is from this website. I spent $ 800 on it and now I’m selling it to you for five.”

[00:17:27]

Amanda Greene: What about in the kitchen? There’s really not a ton you can do in the kitchen. Do you have any ideas about how to make the kitchen feel a little bit more like you?

[00:17:34]

Jami Supsic: Well, I think there is actually a ton you can do in the kitchen. There’s actually amazing peel and stick floor tiles. I mean, they’re unbelievably good and beautiful, and you can replace a bad linoleum floor with something patterned and colorful. There’s also peel and stick backsplash tile. I know that sounds crazy, but it really does look good and it really is practical and wipeable. I just bought these round wood knobs. They were less than $2 each. I painted them a color and I put them on my cabinets and it’s really fun. And then certain things like a kitchen runner, like a 2 x 6 rug can disguise a floor, or little potted herbs, colorful canisters. The overhead lighting in your kitchen may be really bad.

[00:18:16]

Amanda Greene: Your job sounds like a lot of fun. Thank you so much, Jami. This has been really good.

[00:18:20]

Jami Supsic: Thank you. Thank you so much. I appreciate it.

[00:18:24]

Amanda Greene: Hey.

[00:18:25]

Friend: Hey.

[00:18:26]